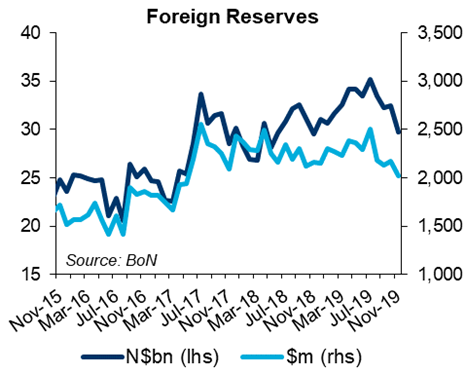

Foreign reserves fall to lowest level since May 2017

By Gerrit van Rooyen

Analyst at Oxford Economics.

The stock of foreign exchange (forex) reserves decreased in November 2019, according to the Bank of Namibia’s (BoN, the central bank) latest Money and Banking Statistics report. The level of international reserves fell to N$29.7 billion at the end of November from N$32.4 billion recorded in the previous month.

The decline was mainly due to the net purchases of rans by commercial banks for import payments coupled with government foreign payments. Broad money supply (M2) growth, meanwhile, accelerated to 9.3% y-o-y in November 2019 from 6.7% y-o-y in the previous month.

According to the central bank, the higher M2 growth rate stemmed mainly from an increase in net foreign assets of the depository corporations. This was partly offset by growth in claims on the private sector coming in marginally lower at 6.4% y-o-y in November compared 6.6% y-o-y in the previous month. Growth in claims on businesses declined to 6.1% y-o-y in November from 6.4% y-o-y recorded in October. Also, the growth in claims on households ticked lower to 6.7% y-o-y in November from 6.8% y-o-y in October.

The growth rates of monetary and credit aggregates remain lacklustre compared to the economy’s boom period during 2010-15, suggesting that the economy remains firmly in recession. We forecast that the economy will contract by 1.8% in 2019, down from -0.6% in 2018. The level of forex reserves decreased sharply in H2 2019 due to a slump in the prices of Namibia’s key export commodities, and the increased need for food and electricity imports owing to serve drought.

Although South African customs Union (SACU) revenue increased slightly in local currency terms in 2019, it actually declined in US dollar terms due to weakness in the Namibian dollar. Nevertheless, the estimated import cover of goods and services stood at 4.3 months at the end of Q3 2019, which is above the benchmark of three months and sufficient to maintain the one-to-one exchange rate with the rand.