Financial data analysts predict China to overtake US retail deposits in only three years

China is set to overtake the USA to emerge as the biggest retail deposit market globally in 2021, according to international data and analytics company GlobalData.

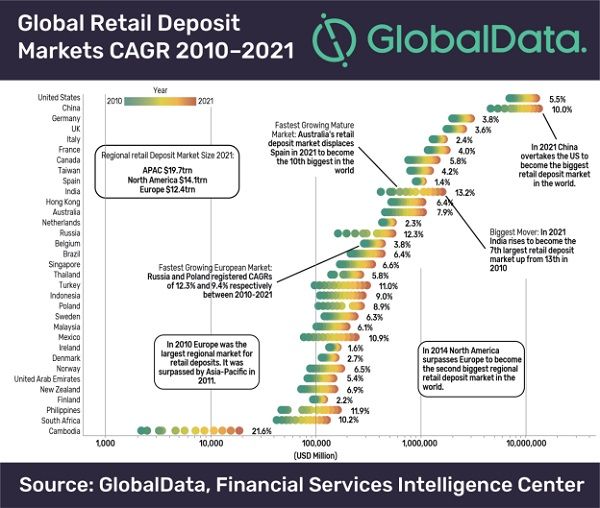

The company’s Global Retail Banking Analytics tool, which has recently published an update on consumer deposit markets globally, revealed that Asian markets have and are expected to perform strongly between 2010 and 2021, while Europe and to a lesser extent, North America, have stagnated.

Macroeconomic growth has led to rising wages and living standards across Asia, increasing the ability of consumers to save.

GlobalData serves roughly two thirds of companies in the FTSE 100 and the Fortune 100 with expert data analysis and innovation tools.

GlobalData’s Retail Banking Analyst Sean Harrison, commented: “Following the 2008/09 financial crisis banks retreated from international markets. Ten years later, continued strong growth across Asia is leading many regional and aspiring international banks to reconsider their strategies.”

The Asia-Pacific region which surpassed Europe to become the largest regional market for retail deposits in 2011, is forecast to value at US$19.7 trillion in 2021, well ahead of North America at US$14.1 trillion and Europe at US$12.4 trillion.

India is expected to be the biggest mover, up from 13th in 2010, to become the seventh largest retail deposit market in the world in 2021. At the same time, Australia is forecast to replace Spain as the 10th biggest based on its consistent economic performance.