Overview for the week and 5-day outlook to Tuesday 29 May 2018

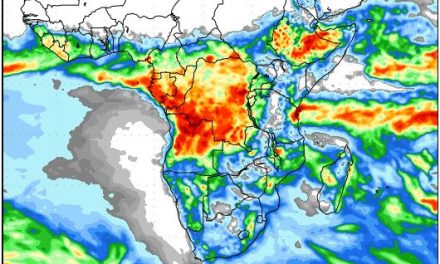

Visual: Accumulated precipitation outlook for the first week of June

Source: GrADS/COLA, George Mason University, http://www.wxmaps.org/outlooks.php

What Happened

The cooling effect of the South Atlantic high pressure cell was felt at the beginning of the week, followed by a gradual return to warmer temperatures, both night and day, as the high shifted to the eastern half of the sub-continent.

The colder Sunday and Monday nights manifested as far north as Otjiwarongo with the biggest impact in the Karas Region, and then a day later (Tuesday) in the Kalahari. By Wednesday conditions returned to an early-winter “normal” but nighttime temperatures generally remained above 10°C. The days were much warmer, hot even, around Mariental, the central northern areas, and the Kunene region.

At the beginning of the week, airflow over the interior was predominantly south with windy conditions above the escarpment. This lasted only a day and by Wednesday, the interior has settled while the wind direction veered to north-east. This change in wind direction brought in a layer of cloud from the north-east which originated in a weak low pressure system over Western Zambia. Scattered clouds continued to penetrate the interior from the Kavango during Wednesday and Thursday but the intrusion presented itself as a classic inversion layer, i.e. a high cloud base between 12,000 and 14,000 feet, and flat cloud tops thus little room for convection.

Except for isolated pockets in the Kavango and Bwabwata, none of the available satellite images portrayed anything remotely resembling a rain-bearing system.

The visual chosen for the week shows a precipitation outlook for the first week of June. Although these outlooks hardly every pan out the way they are projected 12 days earlier, there are however some very pointing clues regarding the general expectation for the winter.

As can be seen from the image, the outlook is based on a very normal Western Cape winter. This indicates that atmospheric conditions on a regional scale have normalised or are expected to continue moving closer to the 30-year mean. On a wider arena, this is corroborated by the Southern Oscillation Index of the Australian Bureau of Meteorology which have turned negative over the past three weeks, but is still regarded as “neutral.” This is a sign of a decaying La Nina in the western equatorial Pacific. Similarly, several ENSO trackers now show sea surface temperatures in the central and eastern Pacific to be reverting to mean, another sign that the La Nina is terminal.

It is still too early to tell how quickly the La Nina, once gone, will transition to warmer El Nino conditions but the general consensus among scientists is that conditions will remain neutral, at least until the end of the northern hemisphere summer, or even up to the end of the year.

If the short-term regional outlook for southern Africa assumes a normal winter stance, and if the leading American, Australian and European met institutions expect a return to neutral, the only safe view now, is that Namibia can expect a relatively normal winter and a normal early rain season later in the year.

If this indeed turns out to be the case, there will be several opportunities for the southern Namib and the Orange River Valley to receive some light rain during the next two months as a spill-over from the Western and southern Cape systems. This precipitation, however, is measured in ones and twos. It may also produce some snow in the Aus region, something which has not occurred for several years.

What’s Coming

Not much activity is expected over the long weekend. The current high pressure cell over the sub-continent stays in place during Friday and Saturday, ridging in over the Hardap and Karas Regions but it is not accompanied by a frontal system.

There is some low pressure intrusion along the coastal plain but the pressure differential is so slight, that if Oosweer is present, it will be mild. The northern Namib may experience windy conditions on Sunday.

It is only by next week Monday night that a change in conditions is expected. The South Atlantic high is then only some 200 km offshore Lüderitz and its impact will be felt on Tuesday and Wednesday. As the South Atlantic high moves onto the main land, its ridges again into Namibian airspace penetrating the territory from the south-east. The core however, remains offshore so while next week will present some cooler nights across most of the interior south of Etosha, the threat of frost is minimal.