Regulation 29, as gazetted, delayed due to errors

A forum between the financial institutions supervisory authority and the industry held on Wednesday in Windhoek, provided many points for reflection, and perhaps for improvement.

This meeting was attended by a whole bevy of officials from the authority, although only three made presentations and participated in the exchange with members from the investment management fraternity. The purpose of the industry forum was to provide investment managers and investment management companies with an update on the progress of the Namfisa Bill and the Financial Institutions and Markets Bill, the so-called FIM Bill. A Namfisa circular dated 01 October 2013 was also distributed giving outlines of the submission process, duly noting all instances and events marking the arduous progress of both bills through the legislative machinery.

I did not get the impression this was a comfortable meeting for the three Namfisa officials who handled the field. First they had to inform the industry that the dates in the gazetted Namfisa Bill are incorrect and must be amended. This automatically implies a suspension of the targeted implementation date, leading to some very piercing questions from the audience. Despite stating numerous times that the final dates and implementation depends on the finance minister’s discretion, representatives of several investment management companies were adamant to know, or at least have a reliable indication of when the gazetted law will actually become enforceable law.

The exchange of words also provided a humorous moment when the chairman had to concede that once a Bill has been gazetted, it is law, but when it is obvious that implementation is stalled due to errors in that Bill, then it is NOT law, until fixed. But one has to understand the frustration of the industry when hiccups like this, or should I say, oversights, lead to a situation where there is a new law, in all legal aspects, but it is not actually enforceable. It is no surprise that most of the meeting’s attention went into the so-called Regulation 29, issued under the Pension Fund Act. This new regulation is an extension of the previous Regulation 28, which has been amended in several material matters, but not discarded. So now we have a Regulation 28 that says a lot, or has said a lot for the past 20 years, especially on Domestic Asset Requirements, and we have a new Regulation, 29, that complements the existing regulation. The biggest conundrum in the investment management industry was always that Regulation 28 set certain definitions for asset classes and quotas for Namibian assets, but that it contained little or no remedies for managers in default. The regulation is fairly strictly adhered to by the investment industry, but everybody knew there was not much in it that can be legally enforced. It was viewed more as a policy document and compliance took place on a gentlemen’s agreement basis.

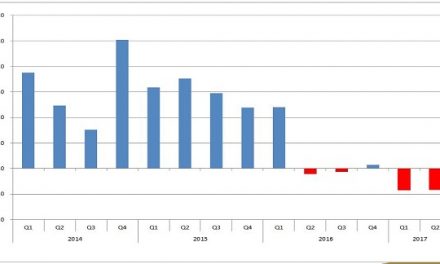

Regulation 29, however, should have been the remedy for everything lacking in its sister regulation, so you can imagine my surprise when the chairman informed us the process has been stalled and that the gazetted Regulation 29 does not carry any actual legal weight, not yet. When a member of the industry pointed out that there is basically only one month left this year, otherwise promulgation will have to be delayed until March next year, the chairman exonerated himself, telling us several times he is not at liberty to comment on the process at the ministry. “Given the error, we will not enforce Regulation 29 as it stands now” were his exact words. A smile came to my face when he elaborated: “We will manage this effectively so that the error does not occur again.” Pressed for a timeline he was reluctant to have himself tied down, but vaguely indicated that March/April next year is realistic, followed by a six-month implementation period. What made me concerned is the fact that the questions from the industry were pertinent and detailed, and that the response from the chair was almost universally one of, we note your concerns and will come back to you with an answer at a later stage. There were also some issues about proper definitions for some asset classes most notably the so-called Unlisted. Furthermore, concerns were raised by the industry that certain restrictions that distinguish between pension funds and unit trusts, run into their own definitional problems were a pension fund, for instance, will invest directly in said asset classes, but may also hold a secondary position through a unit trust investment. Although I have to admit that this is very technical and that only a handful of people in Namibia truly understand the intricacies on which these distinctions are based, I did not fail to notice that those people who work with these issues every day, had valid objections and that the Namfisa panel could not provide answers on the spot. The financial institutions supervisor is supposed to regulate the all-important financial services industry where most of your and my pension money is tied up.

If the regulator lacks in technical competence, who is there from the official side, that will able to regulate this highly complex industry, adequately?