It takes a stout investor’s heart to ride out volatility

Trading on all major markets this week was volatile in the extreme but this failed to be mirrored in the so-called fear index, the VIX. This signals either complacency on the part of investors, or a laissez faire attitude with traders having grown so accustomed to extreme market swings that these excessive movement are no longer taken seriously by anybody.

.It is always dangerous to try and fathom the collective motive of thousands of traders and investors, but the fact that stock and bond trading continued as usual despite the visible volatility indicates there is a widespread belief in the ability of the market to jump back the next day after a painful day of losses.

The JSE is a point in case. The interest rate rise by the Reserve Bank failed to make any impression on the South African stock market, and it failed to improve the Rand’s exchange rate. The currency actually deteriorated last week immediately after the MPC announcement, but for the rest of the week, it stubbornly traded in the R11-20 range. This week, however, it gained back some ground, briefly going stronger than R11 to the dollar on Thursday.

The JSE seemed to take a beating earlier in the week, also losing ground but it did not loose investors and by week’s end, it was heading for 45000 index points again.

Nervous policy makers view the stock exchange and currency movements with trepidation. But it is my opinion, as I also stated last week, that local market movement and the marked depreciation of the Rand since November last year, has very little to do with local interest rates, or with the strikes in the extractive sector. It has everything to do though, with the value of the US dollar and more particularly with liquidity, and perceived future liquidity, in American and European markets.

Despite all claims to the contrary by emerging market policy makers, the combined US and EU markets are still two thirds of the world’s economy. When one digests this fact carefully then it is clear that what happens in China, or the other BRICS, or all the other emerging markets together, causes the odd blimp on the trading screen, perhaps for a day or so, but that the gravity of trading lies in Frankfurt, Zürich, London, New York and Chicago. Conditions in those markets are what matter and global market trends always tend to reflect the sentiment of the capital markets with depth. It was refreshing to read reports this week that concur with my observation that the Reserve Bank flinched too soon. I fail to find fundamental reasons for the rise in the South African short term rates. It is not reflected in the yield curve on the longer end of the spectrum, and although consumer indebtedness has been cited by many analysts as a concern for monetary authorities, it is no different from five years ago, and it is not out of line with consumers in any of the so-called developed economies.

Consumer everywhere are under pressure yet the US government pays only 2.7% interest on its 10-year treasuries, the German government around 1.6% on its bunds, and even in southern Europe, longer dated rates are all below 4%. And this is where the economies, and the consumers, are really underwater. Short term rates, as everybody knows, are zero or very close to zero. Real rates are actually negative in many jurisdictions. Why then, must it be of any real concern to us, if local consumers spend 90% of their income in debt servicing, or why must we be concerned when sovereign debt of countries in southern Africa, exceeds 30% or even 40% of GDP. Compared to the developed markets, we live in paradise.

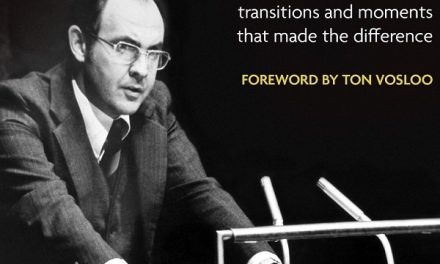

In 2000 or early 2001, I had an interview with South Africa’s financial blue-eyed boy, the then minister of finance Trevor Manuel. One of his more daring and most striking observations was that a weak Rand kills you when you travel, but it is good for everybody else who stays at home. Manuel’ achievements are well documented and his incisive policy adjustments took the Rand from around R13 to the dollar, to the R8-40 level where it stayed for many years.

The recent depreciation of the Rand is in my view a result of the start of a rebalancing process in developed markets and we will not escape the fallout, but as conditions settle, the Rand should also become stronger again, reverting to where I believe it should trade – around R8-60 or even stronger.

We should not worry excessively over currency weakness. If we look after the soundness of our own growth models, we will ride out the dollar moves, and foreign investors, in my view, will continue to look for value in emerging market stock exchanges. I mean, where else can they go? There is much less value in their own markets were these not driven by artificial liquidity.