Weekly overview and short-term outlook to Wednesday 13 March 2019

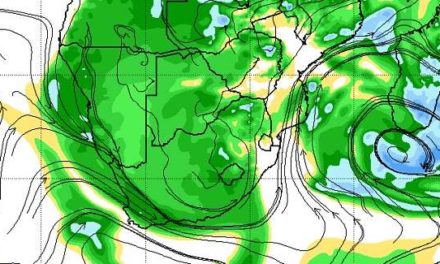

Visual: Forecast map of Relative Humidity at 500 mB for Saturday 09 March 2019

Source: NOAA, National Centre for Environmental Prediction, www.cpc.ncep.noaa.gov/products/international/cpci/data/12/gfs_500mb_rh_safrica.html

Recent Developments

The visual for this week is a rather complex forecast of Relative Humidity at a very specific elevation, the so-called 500 mB surface, or about 18,000 feet aloft.

This is a representative layer to determine Namibian rainfall prospects. Typically in summer, the cloud base would be around 12,000 feet with the cloud tops going to about 25,000 feet in mild weather, and to about 35,000 feet under more convective (unstable) conditions. Thus, at 18,000 feet one has an inferred view of what happens closer to the ground as well as what can be expected higher up.

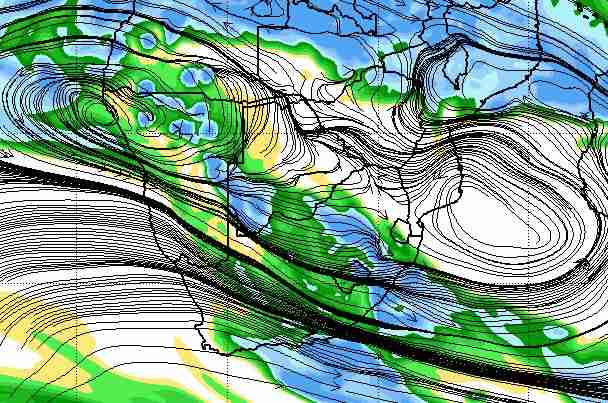

Conditions this week departed noticeably from last week’s prevailing picture. Early in the week, the signature (low pressure) trough from southern Angola through the Namibian interior started developing slowly, witnessed first by intermittent cloud formation, then building in extent, both horizontal and vertical, until Wednesday when about 65% of Namibia’s surface east of the escarpment was covered in cloud systems one way or another.

As can be expected, this produced relatively good falls, ranging from 20 to 25 mm in the Kavangos, to about 15 mm in Owambo and the same in the Caprivi. But the falls were still very isolated, sporadic and of short duration.

Further south, the same pattern was repeated but with lesser amounts measured. From Tsumeb to Windhoek most reports indicate falls of between 5 and 10 mm, and in and around Windhoek, between 2 and 5 mm. From the southern half, the only observation was scattered drops, or “stofnat.”

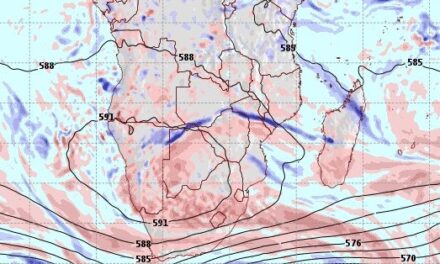

By Thursday, although a broad blanket of cloud developed over the northern, central and eastern regions, rainfall prospects actually deteriorated for the country as a whole. Various satellite images show the presence of the trough and the strong division between west and east of the convergence zone.

The reason for the disappointing precipitation despite the good cloud cover, is what the visual shows. At that level where cloud formation is critical, the relative humidity is low, and with suppressed convection, it remains low even at higher altitudes. There is ample water vapour in the middle levels but restricted to the trough and mostly east of the convergence line. Where the visual shows blue, convection is enhanced and the chances for rain on the surface are good, but where it is green to dark yellow, conditions are poor, and usually only a few drops reach the ground.

This picture has been all too familiar this season.

On the Radar

A strong low pressure system develops over the Western Cape over the weekend, and stay there until about Tuesday. This acts like a vacuum pump drawing in air from the north-east. It also boosts north to south airflow over the Namibian interior, which may lead to some surprisingly strong falls, but only “in places” as the weather service is fond of saying.

The South Atlantic high pressure cell with an abnormally high seasonal reading of 1032 mB approaches the west coast during Saturday and will lead to much cooler conditions in the Karas region, possibly as far north as Rehoboth or even Windhoek. It will also be windy in the southern regions, and very dusty in the southern Namib.

By Monday, the trough over the interior migrates to the east, taking the rain with it. Only the north-eastern quadrant is expected to see some rain.

For the time being, the “thick” atmosphere of early this week, recedes a little, bringing relief from the very hot afternoons. Rainfall prospects are negative, almost for the whole country until Wednesday. The only exception is a narrow strip in Otjozondjupa along the Botswana border.

In general, both daytime and nighttime temperatures will be lower, on average by about 5°C.

The synoptic feature to watch is the expected tropical depression in the Mozambican Channel. It will not have an effect by Wednesday but it can produce sudden changes in the weather pattern later next week.