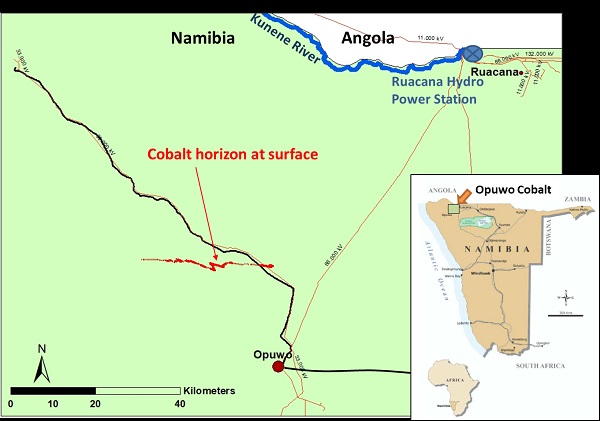

Aussie explorer completes bookbuild for capital to float Opuwo Cobalt Project

Celsius Resources a ASX listed resources company currently focused on the evaluation of the Opuwo Cobalt Project in Namibia, this week in a statement said the company had successfully completed a bookbuild for the issue of approximately 48.6 million shares to raise AUD$ 9 million, at an issue price of 18.5 cents per share.

In a statement on the SENS platform the Placement was well supported by institutional and professional investors from North America, Hong Kong, Europe and Australia.

According to the announcement the funds raised by the Placement will be applied primarily to fund the progression of the Opuwo Cobalt Project, including: Completion of the Project Scoping Study (already well advanced, due June 2018); completion of a Pre-Feasibility Study; resource infill and extension drilling programme; exploration of additional targets identified across the broader Project area, including newly acquired licence and the commencement of a Bankable Feasibility Study (assuming positive Scoping Study/Pre-Feasibility Study outcomes); and working capital.

Hartleys Limited and Aesir Capital Pty Ltd acted as Joint Lead Managers to the Placement.

Commenting on the Placement, Managing Director Brendan Borg said, “this capital raising allows the Company to be fully funded for the continued rapid evaluation of the Opuwo Cobalt Project beyond the Pre-Feasibility stage. With our recently announced maiden JORC compliant Mineral Resource confirming the Project as having what we consider to be world significance in terms of size and strategic value, we look forward to continuing to progress the studies on the Project as quickly as possible”.

The Company does not require Shareholder Approval for the Placement as funds will be raised pursuant to capacity available under Listing Rule 7.1A. Settlement of the Placement is expected to occur on Thursday, 10 May.

Meanwhile, in addition to the Placement, Celsius will offer existing shareholders the opportunity to participate in a Share Purchase Plan (SPP) at the same price as the Placement, to raise a maximum of $3 million via the issue of approximately 16.2 million shares.

“If total demand for the SPP exceeds $3 million, the Company reserves the right to close the offer early and/or to scale back applications as determined by it in its absolute and sole discretion. When determining the amount (if any) by which to scale back an application, Celsius may take into account a number of factors, including the size of an applicant´s shareholding in Celsius, the extent to which an applicant has sold or bought additional shares after the record date and the date on which an application was made,” the announcement stated.

Furthermore,the Directors of the Company intend to participate in the SPP at various levels, however should the SPP be fully subscribed, the directors will cede their rights to enable shareholder participation.

According to the statement participation in the SPP will be open to shareholders who are registered holders of Celsius shares at 5.00pm (WST) on the Record Date of 2 May 2018, and whose registered address is in Australia or New Zealand. The SPP will entitle Eligible Shareholders, irrespective of the size of their shareholding, to purchase up to $15,000 of SPP Shares at an issue price of 18.5 cents per SPP.