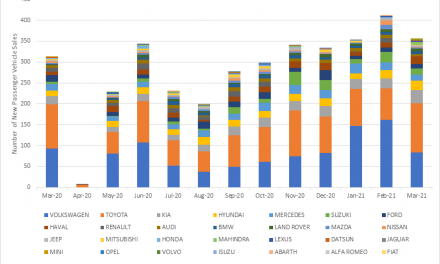

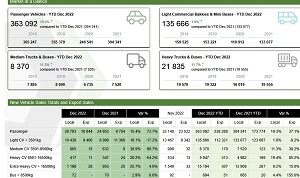

Vehicle dealers go all out to make up for 25% slump in sales

At the end of the third quarter, Wesbank hosts its annual dealer function where the best vehicle salesmen are rewarded for the value of the transactions that they finance through the dedicated asset finance bank.

At this year’s dealer awards held last week, Elmarie Cilliers, the Executive Officer of WesBank Namibia said “We had a camouflage theme to highlight the old saying of tough times don’t last, tough people do. No one welcomes tough times. Yet, during this difficult period some businesses thrive, grow, and prosper. These businesses display an unusual vitality by seizing the opportunity to increase sales, introduce new products and services, and capture a greater share of the market.”

Awards are allocated in several categories based on both volume and value.

For the highest number of deals from a franchised dealership, the award went to Hans Horst of Associated Motor Holdings.

The highest value was achieved by Francois Hanekom of Autohaus Windhoek.

The highest volume in pre-owned dealerships was achieved by Kobus Prins of Zeda Car Sales with the highest value in business coming from Schalk van Greunen of Indongo Toyota.

Among the smaller dealers, Sidonio Alfalate of Gobabis Toyota sold the highest number of vehicles and Diana Viljoen of Steckel’s Toyota brought in the highest value.

The biggest number of units moved by a single-owner dealership was by Izolde van Wyk of Glasgow Investments with Leon van Wyk of Dub Motors signing off the highest value.

Liesel van Tonder, also of Associated Motor Holdings received a special award as the Most Supportive sales executive.

Cilliers confirmed what statistics show that there has been a drastic decrease in new vehicle sales. “It’s clear to see that the decrease in sales reflects a consumer market that is under pressure. Consumer confidence is at extreme low which implies that many consumers will likely be reluctant to purchase big-ticket items, particularly if these are financed through debt at a time when the economy looks bleak” she said.

“Despite what is happening with the greater economy, vehicle sales offer diverse opportunities. Customer satisfaction depends on just one issue: meeting needs on time, every time. It’s never the “value” you want to add that makes the difference, however. It’s the “value” the customer wants to receive that’s important.”

Pictured are Elmarie Cilliers (left) and Aletta Schwarz (right) of Wesbank with Izolde van Wyk of Glasgow Investments and Leon van Wyk of Dub Motors. They were the best salespeople in the single-owner dealership category at Wesbank’s dealer awards held last week in Windhoek.