New vehicle sales in SA surpass 2021, albeit at a slower pace than previous year

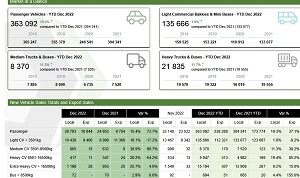

The National Association of Automobile Manufacturers of South Africa (NAAMSA), this week showed sales of cars and commercial vehicles in December totalled 41,783, 16,2% more than the 35,944 units sold in December 2021.

The latest figures show that December 2022 new passenger car market and light commercial vehicle market reflected a sound performance with a year-on-year volume increase of 15,4% in the case of new passenger cars and a gain of 16,1% in the case of light commercial vehicles.

This comes after sales of medium commercial vehicles increased year-on-year by 36,9% while heavy commercial vehicles and buses increased by 23,1%.

“Export sales in December 2022 ended the year on a positive note and at 26,302 units reflected a gain of 5,130 vehicles or an increase of 24,2% compared to the 21,172 vehicles exported during December 2021,” NAAMSA said in a statement.

These NAAMSA figures indicate that, overall, out of the total reported industry sales of 41,783 vehicles, an estimated 37,479 units or 89,7% represented dealer sales, an estimated 7,3% represented sales to the vehicle rental industry, 1,5% to the government, and 1,5% to industry corporate fleets.

The NAAMSA figures also show that following a robust recovery in the 2021 domestic new vehicle market, increasing year-on-year by 22,2% to 464,493 units compared to the severely COVID-19 affected 380,206 units in 2020, aggregate new vehicle sales recovered further by 13,9% to 528,963 units in 2022, but still 1,4% below the pre-pandemic 536,612 units sold in 2019.

In addition, new vehicle sales are regarded as a good barometer of the health of the domestic economy, according to the report.

“Following a fairly upbeat first quarter 2022 industry performance, global supply chain disruptions along with the impact of the devastating floods in KwaZulu-Natal, elevated inflation, an upward trend in interest rates, record fuel prices, as well as record highs in the frequency and intensity of load shedding weighed heavily on both business and consumer confidence,” the report continued.

However, the new vehicle market’s performance in 2022 remained resilient despite the multiple national and international headwinds.

The lifting of all COVID-19 lockdown restrictions in the country in 2022 along with the recovery in business and leisure travel, provided some support to the new vehicle market to counter the growing pressures on household incomes.

Meanwhile, the consumer trend of buying less expensive and smaller cars, usually SUVs or crossovers, continued in 2022. “Stronger sales in the various commercial vehicle segments indicated improved business confidence, even in the tough economic times.”

According to NAAMSA, global economic conditions have deteriorated significantly, given persistently high inflation and aggressive interest rate hikes in many advanced and developing countries.

Findings of the report also indicate that in South Africa, consumer price inflation reached a 13-year high, increasing to 7,8% in July 2022. “As expected, the South African Reserve Bank in 2022 raised the interest rate seven consecutive times since November 2021 and to its highest level since 2016. The higher stages of load-shedding also seemed to have an amplified negative impact on production and the South African economy as a whole.”

As far as 2023 is concerned, the domestic new vehicle market’s performance is expected to remain resilient despite weakening domestic economic indicators and a deteriorating global growth outlook, the report concluded.

“Growing concerns about global “stagflation”, which is high-interest rates combined with slow growth and high inflation, the continued economic impact, and disruption of supply chains resulting from the Russia-Ukraine war, and the current pace of tighter monetary policy in major markets have increased the possibility of a global recession. There is also a likelihood of further near-term global supply chain disruptions stemming from the rapid re-opening of the Chinese economy that has resulted in surging COVID-19 infections.”