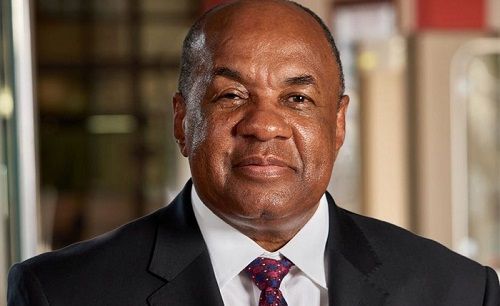

Environment to sustain economic recovery needed says !Gawaxab

The Governor of the Bank of Namibia, Johannes !Gawaxab, at a recent engagement with the banking industry, said it is crucial to step up efforts to create an environment that will ultimately lead to sustaining the economic recovery, economic development, employment creation, and poverty eradication.

Reflecting on the urgent need to lubricate the economy further to support the generally benign economic activities across many sectors of the economy, the Governor observed that credit extension to businesses and households remains muted, which is concerning.

While businesses have been reluctant to incur long-term debt amid the pandemic, the household sector has also been less willing to take on credit due to lower household incomes (largely due to job losses) caused by the pandemic, !Gawaxab noted.

According to the central bank, Private Sector Credit Extension grew by 3.3% on average in the first seven months of 2022 and is expected to grow by 5% in 2022 as a whole. Overall, growth in credit extension to the private sector has remained in the single digits since November 2016 and longer than ever before in the post-independence history of Namibia.

Recognising the critical role banking institutions should play in the recovery, as financial intermediaries charged with the safekeeping of depositors’ funds and lending these safely and responsibly, the Governor urged banking institutions to strike a balance between the interests of all stakeholders in this post-Covid environment and where feasible, to do more to assist the economy, he said.

“We are not out of the woods yet, and our economy desperately needs appropriate stimulus, which can take the form of credit extension for productive purposes to fuel the economy. Banking institutions should continue to lend responsibly to critical sectors of the economy to sustain the economic recovery we have seen over the last eight months,” he added.

The Governor also stated that the pleas of businesses struggling to stay afloat are not falling on deaf ears.

For this reason, the Bank of Namibia has retained the relief measures instituted since the pandemic’s outbreak, such as forbearance in regulatory requirements to provide relief to banking institutions dealing with impaired loans and to support financial lending to the real economy.

“Our fortunes and Namibia’s prosperity are dependent on how we come together as a financial sector, businesses, and policymakers to reverse recent economic hardships, restore business confidence, and revive ailing businesses. By so doing, we can create jobs and put our economy on a more stable footing. I have no doubt that we can stem the tide and turn our fortunes around,” he concluded.