Rental Price Index Report reveals 7.2% surge in average rent prices

By Michel Gaoses.

Last week, FNB Namibia released its highly anticipated Rental Price Index Report, unveiling a noteworthy surge in rental prices over the past twelve months.

The report, which analyzed trends in the rental market, showcased a remarkable 7.2% increase in the fourth quarter (Q4) of 2023, compared to a 4.7% rate recorded in Q3 of the same year. On average, rents hovered around N$7,257 over the year.

Market Researcher Mandisa Van Wyk, responsible for compiling the report, highlighted significant insights into the market dynamics. The three-bedroom segment emerged as the frontrunner, experiencing a substantial growth of 19.1%, with an average rental price reaching N$11,155. Meanwhile, the one-bedroom, two-bedroom, and properties with more than three bedrooms witnessed marginal shifts of 0.6%, -0.3%, and 0.0%, respectively, with average prices settling at N$3,579, N$5,833, and N$21,294.

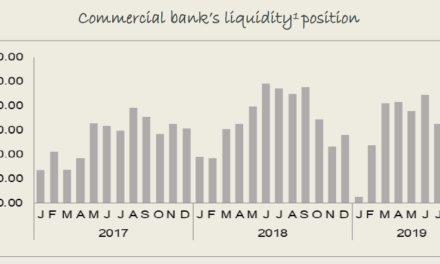

Notably, the report also sheds light on the evolving trends in deposit rates. While the average deposit growth in Q4 stood at 14.1%, slightly below the revised rate of 15.3% in Q3 2023, it remained substantially higher than the 2.2% contraction observed in Q4 2022.

The surge in demand for rental properties can be attributed to the prevailing high interest rate environment, rendering mortgages unaffordable for many. Consequently, individuals are opting to rent for more extended periods, allowing landlords to capitalize on the heightened demand by adjusting rental prices upward for both existing tenants and prospective ones.

Looking ahead, the rental market is anticipated to maintain its upward trajectory, driven by expectations of a slight increase in inflation owing to global tensions and recent fuel price hikes. With the repo rate steadfastly anchored at its peak of 7.75%, any potential easing of monetary policy is projected to be deferred until beyond Q4 2024.

Moreover, FNB remains vigilant in monitoring various factors that could influence the rental market, including loan-to-value ratios, which may stimulate investment in residential properties and subsequently boost the supply of rental accommodations. Additionally, the influx of expatriates for oil and gas exploration activities is deemed another potential catalyst that could impact the rental landscape.

In conclusion, Van Wyk emphasized that the trend of individuals delaying property purchases in favor of prolonged renting is poised to sustain the rental market’s growth momentum in the foreseeable future.