Namibia grey-listed due to anti-money laundering concerns

In a significant development, Namibia has been placed under increased monitoring by the Financial Action Task Force (FATF) Plenary, resulting in the country’s grey listing due to concerns over its effective implementation of international Anti-Money Laundering (AML), Combating the Financing of Terrorism (CFT), and Combatting Proliferation Financing (CPF) standards.

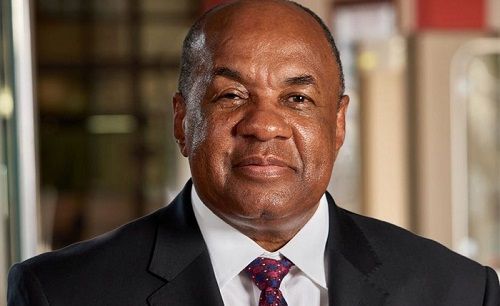

This was announced Friday in a statement by Johannes !Gawaxab Chairperson: AML/CFT/CPF Council.

According to !Gawaxab Namibia, as a signatory to various United Nations Conventions and obligated by mandatory resolutions under Chapter VII of the UN Charter, is tasked with actively preventing and combatting Money Laundering (ML), Terrorist Financing (TF), and Proliferation Financing (PF) to safeguard the integrity and stability of its financial system.

Despite significant legislative efforts to align with international standards, Namibia’s AML/CFT/CPF effectiveness remains inadequate in six of the eleven immediate outcomes assessed by the FATF, highlighting shortcomings in practical implementation and enforcement of regulations, he added

According to !Gawaxab, the FATF’s grey listing publicly acknowledges deficiencies in a country’s ability to counter ML/TF/PF, prompting enhanced due diligence and, where necessary, countermeasures from the global community.

“The FATF Grey-listing has several implications for Namibia, including potential negative impacts on foreign direct investment, trade, and financial transactions. The IMF states that FATF Grey-listing negatively impacts up to 6% of a listed country’s GDP. Entities engaging with Namibia may also be required to conduct enhanced due diligence, leading to increased costs and scrutiny,” he said.

!Gawaxab said that out of 72 recommended actions, Namibia had made significant progress by addressing 59 action items. However, 13 action items within the domains of 6 national AML/CFT/CPF combatting stakeholders remain outstanding, requiring urgent attention.

“To ensure Namibia and the identified AML/CFT/CPF combatting stakeholders timeously addressing remaining identified shortcomings, the FATF prescribed an agreed-upon Action Plan, outlining specific measures to be implemented,” he said.

!Gawaxab said to address outstanding issues, Namibia must swiftly implement the FATF-prescribed Action Plan, which outlines specific measures to strengthen its AML/CFT/CPF regime. The National Focal Committee, comprising public and private sector representatives, will oversee the execution of this plan to restore international confidence in Namibia’s financial system, he added.

Meanwhile, !Gawaxab said despite the greylisting, Namibia’s financial system remains sound and stable, with robust due diligence measures in place to safeguard transactions.

“Businesses and citizens can proceed with confidence in conducting transactions internationally. Moving forward, we are resolute in our commitment to closing the identified gaps swiftly, taking cues from neighboring countries that have effectively managed similar situations. We remain positive and enthusiastic about the future of Namibia’s financial system,” he concluded.