Banking sector remained resilient in 2021 amid torrid economic environment – Report

The banking sector in 2021 remained profitable, liquid and resilient, despite a strained economic environment, according to the central bank’s annual report for 2021 released this week.

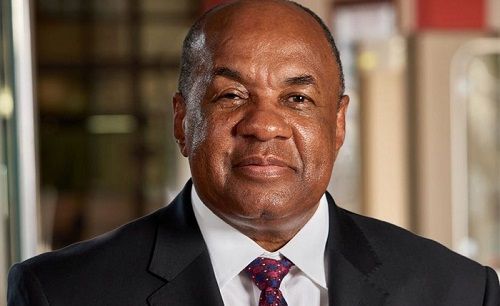

The banking sector remained profitable and held adequate levels of capital to cushion against possible shocks to the economy, the Bank of Namibia Governor, Johannes !Gawaxab said in the report

“The sector’s profitability as measured by the return on equity increased to 13.6% in 2021, from 10.9% in 2020, while the capital position remained healthy, with the capital adequacy ratio remaining above the statutory minimum requirement, and in fact increasing slightly in 2021 compared to 2020,” he added.

On the other hand, !Gawaxab said the asset quality, measured in the level of non-performing loans (NPL), deteriorated further in the third quarter of 2021, when it peaked at 6.9%, though it tapered slightly to the end of the year to 6.4%.

“This NPL ratio level exceeded the crisis benchmark of 6.0% and requires close monitoring,” he added.

Looking forward, !Gawaxab said Namibia needs to map out strategies for the post-COVID-19 era to drive economic recovery.

“The new plan must vigorously pursue economic diversification, improve productivity and competitiveness, and enhance resource allocation to productive sectors. Namibia must raise the momentum of COVID-19 vaccine uptake to increase herd resistance,” he concluded