External debt climbed higher to N$8.8 billion in third quarter of 2021

The total private and public external debt stock increased by 12% to N$8.8% billion n at the end of the third quarter of 2021, mainly due to increased government borrowing from multilateral institutions during the period, according to the Bank of Namibia.

Furthermore, the depreciation in the Namibia dollar during the quarter worsened the debt position in local currency terms as it continued its gradual decline on the back of the weakening of the South African Rand.

The public debt stock increased by 22.3% to N$3.6 billion, mainly attributable to a sharp increase in multilateral loans during this period, while private external debt increased by 5.9% to N$5.2 billion, primarily reflecting higher inter-company lending from foreign parent companies to their Namibian subsidiaries. The majority, 59%, of the country’s total external debt is still owed by the private sector.

The Eurobond debt remains the largest contributor to the public external debt stock. PSG Namibia’s research analyst, Shelly Louw noted that thanks to fiscal consolidation efforts since

2017, the government was making headway towards decreasing debt levels, but the Covid 19 crisis brought a severe blow to the fiscal accounts.

Consequently, Louw added, the government applied for substantial external borrowing and decided to dip into the sinking fund for the 2021 Eurobond to finance the budget deficit.

“Nevertheless, the redemption of the N$500 million Eurobond (which matured in November) went smoothly. The government redeemed the Eurobond by withdrawing about N$100 million from its sinking fund while the balance was paid from the proceeds of a debt assets swap concluded with the Government Institutions Pension Fund earlier in 2021,” Louw stated.

Further, the disbursements of African Development Bank loans as well as the IMF Rapid Financing

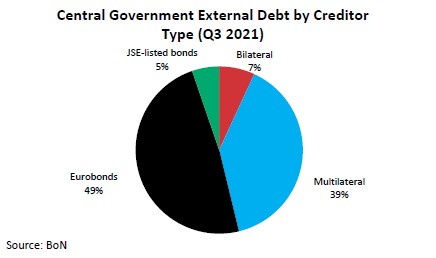

Instrument loan (worth N$4.1 billion) have pushed up multilateral loans’ share of central government external debt significantly to 39% in the quarter under review, from 28% a year earlier.

Meanwhile, the shares of bilateral loans (7%) and Johannesburg Stock Exchange (JSE) listed bonds (5%) have decreased somewhat over the same period. A total of 49% of the government’s total foreign debt outstanding is denominated in US dollars and almost 32% is denominated in South African rand.

The share of the IMF’s Special Drawing Right in the portfolio’s currency composition rose significantly to 10.4% in the third quarter from 0% in the same quarter of 2020, owing to the IMF Rapid Financing Instrument loan.

“We still expect sizeable fiscal deficits in the short to medium term (notwithstanding the fact that we forecast the deficit will narrow somewhat during this period), which implies that the government will require further external finance in the future,” Louw said.

To this end, the Ministry of Finance has indicated that it intends to make more use of rand denominated bonds listed on the JSE.

“Seemingly, the Finance Ministry has grown wary of the currency risk associated with Eurobonds as opposed to rand denominated debt which carries no currency risk. Nevertheless, according to a report by Debtwire, plans are still underway to roll over the N$750 million Eurobond due in 2025. As a result, we expect that external debt as percentage of GDP will remain close to 70% throughout the medium term,” Louw added.