Namibian Beef Sector – The catalyst to transform agriculture

By Helmke Sartorius von Bach

Namibian agriculture can be regarded as the backbone for society, providing food, jobs, and profits for business at local, national, and international level. Its beef sector, for instance, was used as a driving industry during the colonial era, and since the 1970s, cattle farming resulted in productivity gains.

Although early support focused exclusively to benefit the regime at that time, the outcome had significant multiplier effects on the economy within the well-structured agricultural sector.

Global beef demand surging, consumers willing to pay a premium:

Although beef revenue from the area south of the veterinary cordon fence is a small fraction of the national economy, today’s cattle sector still plays an important role in the rural economy of Namibia. Its growth is interrelated with the entire economic process of the economy.

Challenges that impede the beef sector include erratic rainfall, land degradation, inaccessible underground water, bush encroachment, livestock disease, labour shortages, and the ever-increasing cost of production. All these challenges have implications on the long-term sustainability and profitability of the livestock sector. However, despite these challenges, the global demand for proteins, inclusive of beef, is surging. Global consumers are willing to pay premium prices for the sought-after type of beef Namibia is known to produce.

Well regulated beef sector:

The Namibian beef sector is generally well -organized with regulations and standards in place. It is amongst others regulated by the Animal Health Act (1 of 2011) and its regulations to prevent, detect and control animal diseases, and to maintain and improve animal health. This Act authorizes the Veterinary Authority to enable the sector to benefit from preferential trade agreements.

Namibian farmers are prohibited to use growth hormone promotors, and anti-inflammatories’ advantages in production to stimulate growth with lower production costs. These restrictions together with animal welfare and traceability systems in place, can be regarded as determinants for the Namibian free-range beef to be included in the list of prime beef exporting countries earning higher revenues than those exporting commodity beef.

Historically at 5% of GDP:

With these principles in place, the agricultural contribution to GDP (excluding fishing) averaged 5% annually since Independence, of which the livestock sector historically contributed approximately 70%. However, this proportion declined to an estimated 60% in the past five years. The following figure presents how the agricultural sector declined in economic value, which can partly be attributed to prolonged droughts and the global economic recession.

Decline in beef profitability linked to rural economic decline:

Despite government’s commitment to the development of the sector, agriculture did not yield the anticipated growth, food security and wealth. The total factor productivity of the livestock sector declined, especially since 2007. In comparison, the land as separate production factor did not show such a drastic decline in productivity. Beef producers’ profitability consequently declined, which contributed to the declining rural economies of Namibia, reflected in many villages and town’s deterioration.

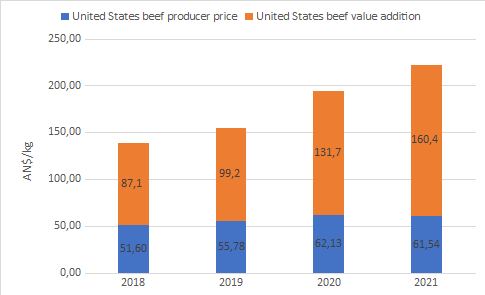

US beef 3-year turn-around strategy:

Recent research shows how countries with similar circumstances and prime beef classification reacted to the global recession and reversed their beef industry into booming endeavours. The figure below shows how the beef producer prices of the United States of America (US) increased from 2018 to 2021. This is the result of the US strategy to avail beef for local high-end consumers, but also to focus on increasing beef exports. This strategy resulted in doubling USA beef value addition within 3 years. It means that trade targeted consumers paying more for prime beef and that beef is no longer traded as commodity beef as was done five years ago. The marketing strategy outperformed inflation and allowed slaughterhouses to share benefits with ranchers, by increasing the producer beef prices; the October price was listed as N$63.97/kg.

Australian beef producer price equals N$112.63/kg:

Australian beef producers historically earned lower prices than US beef producers. In 2018, they only received 80% of the US producers’ price. A year later, Meat and Livestock Australia (MLA) launched their ten-year strategic plan to avail a trusted source of high-quality protein for the high-income consumer. They invested in a complete global meat export network to obtain better prices.

From the figure below, it is evident that their strategy resulted in significant improved beef producer prices. The October producer price was listed as N$112.63/kg for the same classified beef as the Namibian cuts. In contrast to the US, MLA did not follow the approach of indirect marketing but targeted directly the retail stores. They placed emphasis on trusted and traceable beef for the customer, processed in state-of-the-art facilities. The cost of trading their produce compared well to most beef exporting countries. The average Australian beef cuts in global retail shelves currently price N$220/kg, and it excludes the Norwegian market.

Australian farmer’s share increased:

It is interesting to note that the Australian beef producers’ value chain share relative to the final beef product on the shelf, improved from 30% to 43%, whereas the US producers currently only obtain a smaller share of 28%. The Australian example shows how the implementation of a strategy to target the same global customers as any other beef exporter, can result in benefit sharing for cattle producers, which further stimulates local rural investments.

The Namibian farmers @ N$55/kg – Quo Vadis?

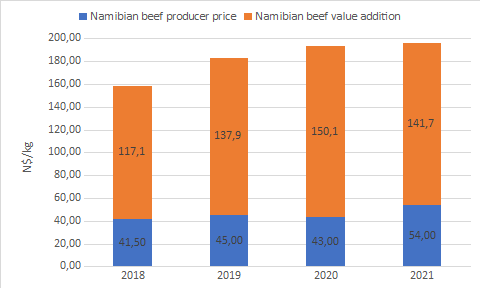

Local reports show that the Namibian beef value chain compared favourably with most global beef sectors until 2018. The figure below portrays how the Namibian industry lost this advantage. The Namibian beef farmer received more than the Australian farmer until 2019, but today, Namibian farmers only earn half of their Australian counterparts. The Australian beef producer price for October 2021 was N$112.63/kg, while the current price offered to the Namibian farmer is N$55/kg. The Namibian producers’ share to the final balanced selective beef cuts (traded on Namibian, South African, European Union, Norwegian and Chinese shelves) remained on a low level equal to the US context, showing that the producer is not benefitting like in the case of Australia.

More income for the farmer drives investment in rural economy:

The above discussion shows that the high beef producer price in Australia resulted in an average beef farming profitability of 24.4%, whereas the lower Namibian producer prices only allowed for 17.7% profitability. In the early 2000’s, the Namibian profitability of beef production was above 25%. It is clear that Namibia needs to find a strategy to significantly reduce beef processing costs and to revise its marketing strategy to ensure that output increases results in higher returns.

A scenario where the Namibian beef producer prices would increase to the level of American farmers would result in a profitability of 29% for Namibian farmers. In case of the Australian producer price level, the Namibian farmers would even reach 34% profitability, which would result in the tripling of farmers’ income taxes paid to the Receiver of Revenue, in significant employment creation in rural areas, and in more investment in farming resulting from the multiplier effects. This could reverse the current socio-economic decay in many rural areas.

Beef as foreign currency generator:

Therefore, with the likely benefits, an enabling production environment for the beef sector should be a priority to position this sector again as a strong agricultural sector that builds a formidable and competitive manufacturing base. It would however require that all stakeholders in the value chain have to become more effective and efficient, to ensure a hormone free, free-range, and trusted, traceable product, processed at reasonable prices to be availed at local and global markets, but to be marketed directly to consumers at a price that Namibian beef demands.

Cut the middleman:

We cannot afford to sell beef cuts below the market value and to follow inefficient value chains anymore. Any future strategy will depend on minimizing losses, to find the best diversified market for specific cuts, and to reduce the supply chains. This will stimulate growth at home, decrease unemployment, reduce poverty and reduce inequality.

Rwanda is leading the continent by example:

Some years back, Rwanda’s food sector was in a similar position as Namibian agriculture now. But since its government implemented their revised agri-food and business sector strategic plan in 2009, changes followed. Rwanda’s animal production grew by a weighted average of 18.8% per year and two decades later it was more than three times bigger than in the 2000’s. This allowed household income to double and poverty levels to reduce from 60.3% to 39.1%. These positive economic changes resulted in Rwanda transforming its historical agricultural practices into a booming sector.

Today, Rwanda is known as the leading example of the African Union. Rwanda is among the ten fastest growing economies globally. It took Rwanda only a decade to benefit from wealth creation and resilience, both in rural and urban areas.

Namibia has the same opportunity:

Never too late – It is never too late to bring the same positive change. Rwanda’s implementation process can be used as guide for transforming our beef sector too, and to bring about effective changes to the areas north of the Veterinary Cordon Fence.