An economic government or a government economy – which do you prefer?

The fallacy that the government is the source of money is a widespread belief in Africa. This is perhaps the most important reason why political processes all focus on the acquisition of power, and then hysterically clinging to it, regardless of the long-term detrimental effects to growth and economic development.

Not being able to distinguish between money and wealth is almost universal since it is so obvious that everything in life is driven by money.

And when one is a citizen of a country where the majority struggles daily to eke out an existence, it is unreasonable to expect the ordinary man in the street to understand the deeper philosophical ramifications of misunderstanding the fundamentals of money, capital, wealth and prosperity. But this is not only a grassroots defect, it is almost universal.

Again and again, remarks by supposedly enlightened people, reinforce this notion that the government has a responsibility to fund this or that.

This belief is so widespread that hardly a day goes by without somebody saying in an interview, the government must intervene and must provide funds.

Pinpointing this malady is not as straightforward as it seems. Although there is a modicum of truth in the observation that the government has a certain responsibility towards its citizens, the fundamentalist conviction that it is the creator of wealth, is completely false. The people I come across that holds this almost universal view, are either stupid, or they benefit from perpetuating such nonsense.

The moment one starts explaining that the government is the custodian of its share that it skims off the national wealth, and can only distribute these particular funds at its discretion, a wet sock appears to be pulled over the face of whoever one tries to educate. The government is the custodian of the fiscus, but do not waste your time trying to explain that even the fiscus runs on the taxes on sales and profit generated by private enterprise.

As long as the vast majority of my co-citizens believe wealth comes from the government, we shall remain stuck in the so-called poverty trap.

The fact that all taxes can only originate from enterprise escapes even some of the more learned colleagues, especially those holding fatcat positions whose salary cheques are signed with a facsimile of the State Revenue fund emblem.

It cannot be repeated too often that the combination of enterprise and entrepreneurship, is what drives an economy. We can add all the academic divisions we want like land, labour, capital, interest, machinery and what have you, but the underlying fundamental truth that all these are useless without entrepreneurs, escapes many people that I deal with regularly.

This dependence on the government as provider is so deeply ingrained in our psyche that people start believing a project or an investment, even a new business idea, is not viable unless funded and driven by the government. How does one then, in such a sea of contrary expectations, make people see the truth and realise that long-term prosperity is only created by entrepreneurs. If it were not for companies, paying tax, the rest of the chain would not exist, but try and explain this to a local audience.

One may think that this form of thinking only belongs in primitive societies but even in relatively progressive circles, I encounter this intellectual debate on government dependence. If only there were some magic potion to administer so that people can start believing in themselves and strive for more than just government hand-outs.

I am notorious for often saying that we are a society of beggars and thieves. What we can not convince the government to give us voluntarily, we have to contrive ways to get it into our own pockets. Unfortunately, this statement, unfounded or not, reflects in part that pervasive dependence on government spending.

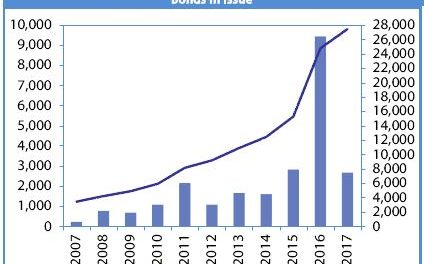

An even more misplaced concept lately, is that the government has unlimited scope to borrow. I mean how can you counter such a viewpoint if it is so easy to show how unlimited the depth of the capital market can be. Don’t bother trying to counter this idea by showing which direction government borrowings go, in a relatively short time span. And don’t even waste your time citing Zimbabwe as an example where it took about four years to kill the economy and another four years to sink the currency – permanently.

What have you done this week, to take care of yourself and your family