Inflation down to levels last seen in the first semester of 2015

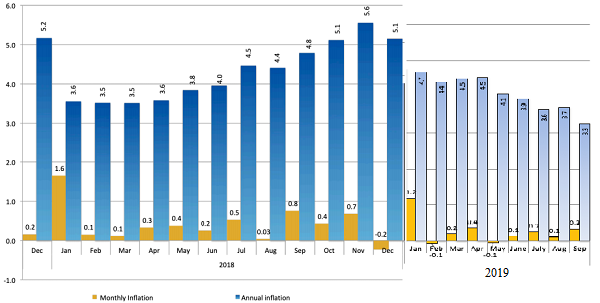

Consumers’ buying power is still cooling at a rapid rate as indicated by the low headline inflation for September 2019, reading only 3.3% compared to 4.8% in September last year.

Headline inflation was this low the last time in 2015 when in May and June it measured 3%. In April 2015, headline inflation was at its lowest at 2.9% and in the second half of 2015, it hovered in the range from 3.3% to 3.4%.

In the period preceding 2015, headline inflation was in similar territory only in October and December 2010 at 3.2% and 3.1% respectively. In February 2011 headline inflation measured 3.1%, the last time at such a level before it started increasing fast, reaching 7.6% in November 2012.

The Statistician General, Mr Alex Shimuhafeni said on Tuesday the “annual inflation rate for September 2019 slowed from 4.8% recorded in September last year to 3.3% and on a monthly basis it increased from 0.1% to 0.3%”

Despite the slight upward tick in month on month inflation, headline inflation continued its pronounced downward trajectory, down from 3.7% in August this year, and much higher levels around the 4.5% mark earlier in the year. In January, headline inflation still measured a not-insignificant 4.7% but far below the all-time high of 8.2% in January 2017.

Commenting on the latest price movements, Shimuhafeni further said that the continuing slowdown in inflation constitutes a 1.5 percentage point move over the period of one year.

The lower September inflation resulted from “slowdowns recorded in: Transport (from 12.9% to 2.5%), Alcoholic beverages and tobacco (from 5.6% to 3.3%), Health (from 5% to 3.2%), Housing, water, electricity, gas and other fuels (from 3.8% to 2%), Miscellaneous goods and services (from 3.9% to 2.7%), Recreation and culture (from 5% to 4%) and Hotels, cafes and restaurants (from 3.6% to 2.8%).”

“The twelve months annual average and monthly average inflation rates from October 2018 to September 2019 stood at 4.4% and 0.3%. Corresponding rates recorded during the same period a year earlier stood at 4.3% and 0.4% respectively.

The average annual and average monthly inflation rates for the period January 2019 to September 2019 were estimated at 4.1% and 0.3% respectively.”