When to start saving for retirement: Part 3*

The accepted wisdom is that you need to start saving for retirement as soon you are employed, but if you are late it is worthwhile to start as soon as possible.

A century ago Albert Einstein shook the foundations of our understanding of the universe when his theories of relativity changed the way we think about space and time. His theories reframed time as a relative and subjective experience. Although science may now think differently about time, our everyday experience continues to tick over in a clock-like fashion. And it is this constant stream of future becoming present becoming past that gives time its economic value.

Time is an irreplaceable resource

You can’t buy or sell it. And nowhere is this more apparent than when you need to make a long-term decision: like when to start to save for your retirement. The more time you dedicate to your retirement savings, the less you need to invest and vice versa.

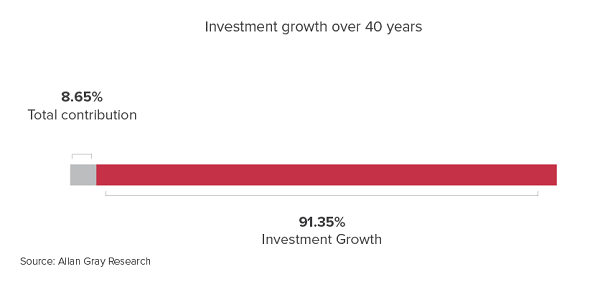

The chart below illustrates this point.

If you started investing for retirement at the age of 25 with N$1000 a month until you reached retirement age, you would have N$5 550 348 by 65 (assuming 10% annual return). The remarkable story here is that 91.4% of your final sum would come from compounding, which means you would have only paid N$480 000 over four decades to reach the total amount.

Time allows compounding to vastly increase a small sum by creating a snowball effect. Imagine rolling snowballs down two peaks, one higher than the other. Naturally the snowball rolling down the higher peak will collect more snow and result in a bigger snowball when it gets to the foot of the hill. The higher peak represents our younger saver: in the same way the interest earned in the first year of saving is added to the capital sum and increases the interest earned the next year and so on and so forth. The bigger the snowball gets the more snow it collects as it rolls down the hill.

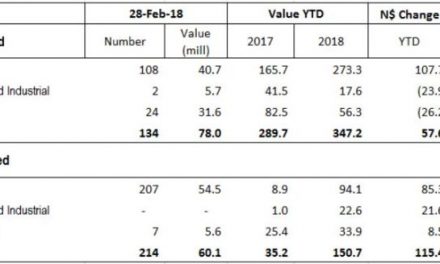

The second shorter peak, representing a 35-year old, will result in a smaller snowball with the same sized starting ball. The shorter runway means the snowball has less time to accumulate. The same is true of your retirement savings. The more interest you earn earlier, the higher the interest on interest will be. Table 1 illustrates this point.

The point of this analogy is to show the snowball effect of compounding only works for you if you give it time. Start early or start now – just make sure that you do not waste any time that could help your investments grow.

* This article forms part of a series prepared by Allan Gray Namibia.

For more information and assistance contact Allan Gray Namibia at [email protected] or visit www.allangray.com.na or call 061 221 103.