Failing to bring its wage bill under control, the government now has access to the ideal instrument to reduce its personnel expenditure

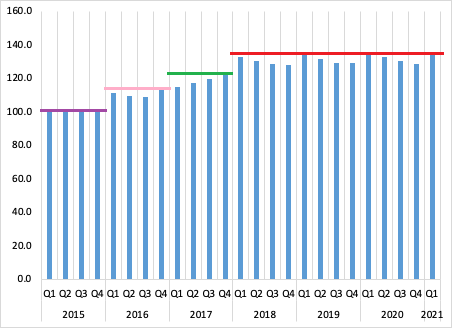

It is almost a year since the statistics agency published the first Government Wage Index but still there is no sign whatsoever of the public service wage bill getting softer. As a consolation, it has not grown either, but remains static, more or less at the same level as a year ago.

For the hairsplitters, note that the index’ introduction states that the latest quarterly value increased by 0.1 percent over the year, although I have a sneaky suspicion the statisticians actually mean one percentage point. Nevertheless, the index value increased from 134.5 to 134.7 over the course of 12 months. Go figure!

According to the information available, the first Government Wage Index was published on 15 July last year. I have to admit, I cannot recall ever seeing this index before despite diligently following all the releases from the statistics agency. But that does not mean they were not published, or not published every quarter since it is a quarterly index, it only means I missed them somehow.

So to me the Government Wage Index is a novelty which by necessity means that I am curious about its methodology.

According to the methodological notes attached as Appendix 1, government workers are classified according to functionality, in line with the International Standard Industrial Classification of all Economic Activity. I have no problem with adopting that three-way split as long as this classification remains the framework for all subsequent wage indices.

Like all indices, the value lies not in the nominal values, but in the change since the latter, over time, reveals the trend, and the trend is what we need if we want to design workable, practical, common sense policies.

The methodological notes state further that the data sets are in essence the government’s payroll as administrated by the Ministry of Finance. It covers only those workers who are employed by central government, in other words those who are bona fide public servants and not persons working for paratstatals or statutory bodies. This too is fine.

The wage index is a weighted index, derived “as a sum of the average wage and worker with correspondence between grades within the respective government sectors.

Now, this is where the methodology departs from my radar. I was asking myself, why does the wage bill needs to be indexed according to grades since it is obvious that many more individuals will work in the lower grades than in the higher grades – a simple pyramid of functionality versus compensation.

In the end, the entire wage bill is processed monthly by a single ministry. There is no consolidation of data or data sets required. The wage bill is a given size and when the paymaster has hit the enter key to release the payments, the ministry knows exactly how much money has left the treasury.

This may be somewhat technical, but I believe it is important that one considers such fundamentals when compiling an index because the index will only have value if it proves to reflect reality close enough that it can be used as a proxy to determine the government’s financial position immediately before and immediately after a salary run. I mean, that is the basics of cash flow management.

Finally, the methodological notes state that the index is harmonised with the National Accounts base year, which currently is 2015. This makes sense, and I would assume that the index will be rebased automatically when the National Accounts base year is adjusted. There is no problem with this but it does imply that the first five years of the index were extrapolated from 2016/17 data. Whether this will be tenable in future, will only become apparent as the index grows over time.

Perhaps what is most important is that this index clearly shows that the government’s own commitment at the beginning of 2017 to reduce the civil service wage bill by 2% per year, was complete nonsense, something which I doubted then, and still do.

However, the index also points to a major opportunity for the Ministry of Finance and I sincerely hope they do not let this one slip through their fingers. If we now have a quantified, benchmarked index of government wages, and it is weighted according to standard HR gradings, like the Patterson system, then all the ministry needs to do is tell its formidable (in number) civil service that all wages will be reduced by 2% per year, according to grading.

I can only chuckle when I think of the uproar it will cause, but it also means that within 10 years, we will have solved a part of our budgetting and debt problem, at least to the extent where we no longer will need to borrow money just to cover the deficit to continue remunerating people who, on weighted average, are not worth what they get paid.