Debt to equity, equity to debt, its all a natural part of the business cycle

A spattering of exchanges at the highest government level this week confirmed the notion that the economy currently runs on sentiment and not on investment and consumption as it should.

Early in the week the President told us things are under control and that the government is taking care of the backlog in payments to construction companies. Then a day later the official opposition retorted with a rather scathing reply, telling us everything is not OK and that the President’s view is flawed.

Still, another day later, a bank tried to tell us we entered a full-blown recession in June this year, although I suspect they actually meant June last year.

Who is to be believed?

The economy is in a consolidation phase and will remain so for this quarter and the next, but I do not believe it is in recession. It was in a recession for three quarters, two in 2016 and the first calendar quarter of 2017. Preliminary indications are that it grew modestly in the second calendar quarter of this year. That quarter ended on 30 June, but there are no statistics available as of yet, to tell us what the outcome of that quarter was. That information we’ll only start getting from the middle of September.

If I make the statement that the economy is in a consolidation phase, it becomes necessary to define clearly what is a consolidation phase, what are the characteristics, and how does one know when consolidation has come to an end.

The economy entered a technical recession in the second quarter last year, but that is not a calendar quarter, it is the fiscal quarter, so it means the period July, August and September. Many analysts refer to it as a technical recession because, by definition recessions are measured in quarters and you have to have three of these, back to back, before it is deemed a recession.

For instance, the economy can be in recession for one quarter or even two when growth is marginal but then grows slightly in the other two. If it turns out that over the four quarters, be it a calendar year or a fiscal year, the economy is actually bigger than at the beginning, it means it has expanded, regardless by how much or how little. The two negative quarters are then deemed a technical recession.

If I look at eight specific macro-economic indicators (which I discussed in a previous article), I have good reasons to believe the second calendar quarter this year, was positive. However, I shall be the first person to stress that this growth will be very small, and may only reflect in statistics a year from now. I think the important point is to try and establish whether the contraction has stopped because by definition that is the end of the recession. And I believe that is what happened.

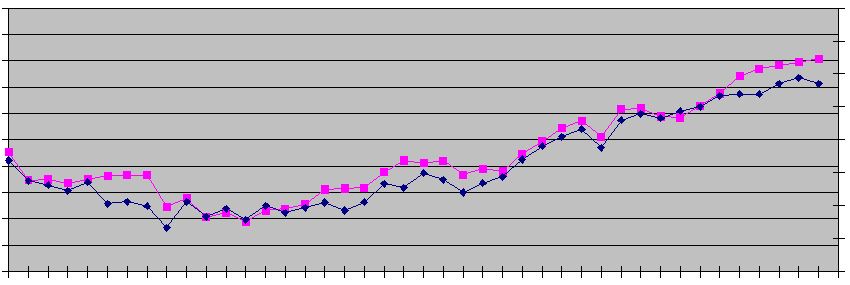

During times of profit, companies turn debt into equity and during times of loss, the reverse happens, equity is turned into debt. So, in a consolidation phase, companies pull out all stops to reduce their losses. The typical strategies happen on many fronts, and cover many aspects of a business. But often the results are not immediately apparent.

They therefore go into a savings mode, cutting all unnecessary expenses, consolidating their debt positions, fall back on reserves, and ensure that they have adequate funding in place to continue operations. In the meantime, they have to continue trading, pay their employees and service their liabilities, both to their bank and to their suppliers.

This has a ripple effect on the rest of the economy. Everything slows down, liquidity is impaired and there is a serious shortage in available credit.

The government, viewed as a business does not escape the necessity for cost-cutting and streamlining. It also has to align its operations to new realities during recessions.

But at some point, equilibrium is restored, only we do not know it immediately because it does not show up in financial results. But the bleeding has stopped and that is when the economy goes into consolidation phase, meaning maintaining the status quo just to be able to continue to operate. This applies equally to the private sector and to the government.

Then at some point, companies notice their sales are improving, tentative at first, and with a little more momentum. But they do not trust the monthly figures, hence they remain in consolidation phase, hanging back to see which way things are going and whether the slight improvement was just a blip or the beginning of a trend. This may carry on for six months, nine months or even a year.

Our scare started in earnest around August last year, so we are now almost a full year into the process. It will take some more time before financial managers are prepared to ask their boards to resume intended investments.

When this happens, growth is restored, companies hire more people and more money starts flowing into the system. This leads to improved bank liquidity which is the precondition for improved credit conditions. At this point, the economy starts generating its own new momentum and growth returns.

Based on my own assessment, I do not think we are far away from that point, i.e. the end of the consolidation phase.