Development Bank sheds tentative light on secret Ohorongo majority sale

In a carefully worded statement released on Thursday, the Development Bank of Namibia stated that it was not informed of the deal to sell Schwenk Namibia to an international investment group, until a day before the sale agreement was signed. That day was a Sunday.

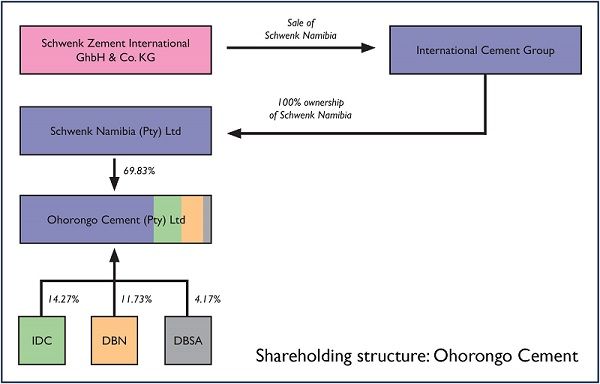

Schwenk Namibia, a subsidiary of German industrial giant, Schwenk Zement International GmbH, is the holding link between the wholly owned parent and the Namibian operational entity, Ohorongo Cement Pty Ltd. It holds 69.83% of the equity. There are three minority Ohorongo shareholders, the Industrial Development Corporation of South Africa with 14.27%, the Development Bank of Namibia with 11.73% and the Development Bank of Southern Africa with 4.17%.

The sales purchase agreement between Schwenk Zement International and International Cement Group, lists the transaction at a consideration of US$104.4 million, approximately N$1.5 billion. This indicates that the buyers valued one Schwenk Namibia share equal to US$1.5 million. It further implies that the Development Bank of Namibia’s shareholding is worth around US$17.6 million or N$255.5 million at the exchange rate at the time of signing the purchase agreement.

“The Development Bank of Namibia and its shareholder the Government of the Republic of Namibia were not aware of Schwenk International’s intention to sell. The minority owners and shareholders of Ohorongo were only formally informed about the transaction at its last Board Meeting held in Windhoek recently,” the Development Bank of Namibia stated.

According to the bank, the purchaser appears to be a predominantly Chinese-owned company listed on the Singapore Stock Exchange, trading as International Cement Group.

The bank pointed out that the transaction does not affect their ownership in Ohorongo Cement, neither is there a dilution of shareholding. What is not explained is the obvious obsolescence of Schwenk Namibia as a holding company unless it has other commercial interests of which the Development Bank is not aware.

Signalling the uncertainty about the way forward and the bank’s continued position as a shareholder, it said these issues will only be clarified after consultation with the government.