Consumer confidence slumps as Brexit negotiations stumble to the finish line – GlobalData

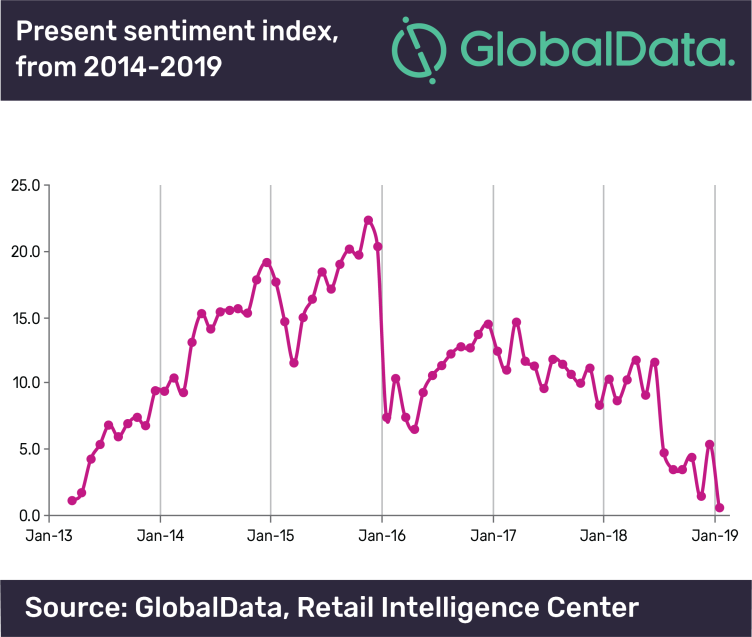

Present sentiment index fell to +0.6, its lowest level since its inception in March 2013, as UK consumers grow increasingly unsure regarding the UK government’s Brexit negotiations and what this means for them financially, according to GlobalData, a leading data and analytics company.

Zoe Mills, Retail analyst at GlobalData, said “with parliament unable to agree on a plan for after 29 March, when the UK is scheduled to exit the EU, consumers are shunning discretionary spend, concerned regarding the affordability of essential products and anxious about job security.”

According to GlobalData, the present sentiment index, which captures views on a number of areas such as affordability of discretionary treat spend, store visits and perceptions of whether now is a good time to make large purchases such as a new television or a new car, has witnessed a persistent downward trend since January 2017.

It looks set to fall into negative territory for the first time in its six year history this month, as Theresa May concedes to potentially delaying the UK’s exit to June 2019.

The index witnessed a lag in this declining trend after the UK voted to leave the EU in June 2016, as Brexit voters remained optimistic about the country’s future in the immediate aftermath.

However, as talks drag on with limited resolution, consumers are growing more concerned about the negative implications of a no-deal Brexit, which has become a realistic possibility.

The appeal of January sales has been limited given the high level of discounting at the end of 2018 and as such, there is little that retailers can do to encourage spending until consumers are certain about what will happen from April.