3rd Africa Resilience Forum looks at concrete actions to address the challenges posed by migration

Abidjan – “I can attest that migration enriches our lives while allowing us to learn and contribute.” On Monday 4 March, the Bank’s Senior Vice-President Charles Boamah opened the third annual Africa Resilience Forum (ARF), by detailing the benefits that safe, controlled migration bring to countries of origin, transit and destination.

In the presence of the Ivorian Minister of African Integration and Ivorians Abroad, Ally Coulibaly, his colleague Mamadou Touré, Minister for the Promotion of youth and Youth Employment, and of the diplomatic corps and staff and senior management of the African Development Bank, Mr Boamah commended the choice of the conference’s theme on migration issues:

“This year’s theme, fragility, migration and resilience, could not be more pertinent, because we are going to focus on several issues, including the relationships between migration, humanitarian issues and security; youth and job creation; migration and gender; and climate change and the impact on the environment,” the Vice-President noted in his address at the Babacar Ndiaye Auditorium at the Bank’s headquarters.

Policy makers, representatives of international organisations, researchers, members of civil society and businesspeople will continue to consider migration in the context of fragility and resilience in six plenary sessions and eight parallel workshops through 5 and 6 March.

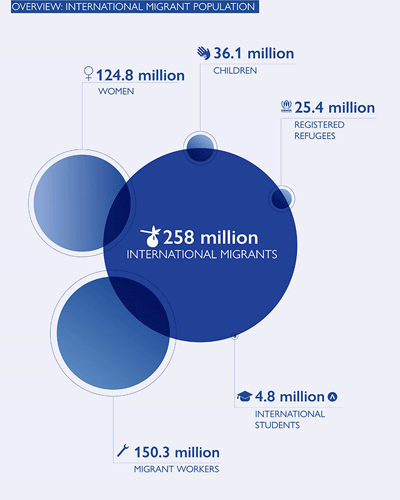

In 2017, Africans accounted for 10% of the 258 million people who migrated worldwide.

“Understanding migration is, therefore, important for the African Development Bank, because this work provides options to support programmes that will reduce migration flows at the same time as increasing yields. While most of the discourse on African migration focuses on the Mediterranean, it is important to stress that general intra-African migration accounts for 70%. This percentage rises to 80% for sub-Saharan Africa,” Boamah added.

A plenary specifically dedicated to “innovative solutions in the field of migration”, including financial solutions, will highlight how poverty and low employment prospects become powerful drivers of migration and instability.

The “Migration-Security-Development” triangle will be at the heart of discussions at another plenary session when participants will review migrant-smuggling and the impacts of tightened border controls with the goal of exploding popular myths about migration. Migration within the African continent will be discussed during a parallel session on “Intra-African migration: challenges and policies”, while another workshop will focus on “climate change, migration and building resilience”.

A single platform for discussion and debate, the Forum was organized by the Transition States Coordination Office with support from the Swiss Agency for Development and Cooperation (SDC) and the participation of the International Organization for Migration, the Office of the United Nations High Commissioner for Refugees (UNHCR), the International Labour Organization and the Making Finance Work for Africa initiative.

The debates held at the Forum will benefit from the new Country Resilience and Fragility Assessment (CRFA) tool, which uses the concept of the internal and external pressures on countries and their capacity to address these.

“Migration challenges require bold responses. In this regard, the Bank has developed tools. The CRFA is an excellent tool to build resilience in our regional member countries,” Boamah said.

The African Development Bank is also working on migration in collaboration with the African Union, the United Nations Economic Commission for Africa (UNECA), African civil society and African businesses..

The President of the Bank, Dr Akinwumi Adesina, is a member of the high-level panel on migration, chaired by ex-President of Liberia Ellen Johnson Sirleaf, and 15 others including the Executive Secretary of the Economic Commission for Africa, Vera Songwe, and former Prime Minister of Senegal Aminata Touré.

In 2011, the African Development Bank provided substantial assistance to Libyan refugees in Tunisia. In 2015, it extended its aid to refugees in Djibouti, as well as similar projects in Burundi, Mali, Nigeria, Senegal and Zimbabwe.

The Bank has also launched the “Jobs for Youth in Africa” programme, which offers young Africans employment, particularly in the agricultural sector, and to prevent youth from succumbing to the temptations of migration.

Over 400 participants from around the world are taking part in the Forum, which will propose concrete actions to address the challenges posed by migration and to help build resilience within the 21 African countries classed as fragile.