Debt free Marenica continues to expand its uranium portfolio in the country – MD

Australian Stock Exchange listed company, Marenica Energy this week on the SENS platform announced that the company is debt free, having eliminated debt of US$1.65 million by the issue of 2.85 million shares to Hanlong Energy Limited at the pre-agreed price of $0.58 per share.

According to Marenica’s Managing Director Murray Hill in the statement the company is now debt free and comfortably funded to continue its strategy of acquiring projects and new tenements with mineralisation amenable to U-pgrade, while continuing to advance the company’s U-pgrade beneficiation process to third-party mining and development projects.

“We have excellent working relationship with the authorities in Namibia and now that we are debt free and cashed up, we can increase our development efforts in Namibia,” he added.

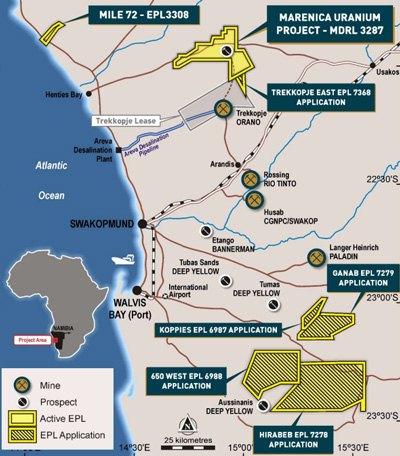

Hill said the company is pleased to be in this position at the same time as Deep Yellow Limited ) is having exploration success at the Tumas Deposit EPL 3497 in Namibia, with some exciting results only 200 metres west of Marenica’s tenement application EPL 6987.

The location of Deep Yellow’s most eastern drill lines (refer Deep Yellow ASX announcements 17 October and 5 November 2018) are shown relative to Marenica’s tenement applications.

Meanwhile, Marenica has now applied for five tenement applications in Namibia, which it believes to be prospective for calcrete-hosted uranium mineralisation.

“All tenement applications are currently undergoing due process with Namibia’s Ministry of Mines and Energy. These applications complement Marenica’s namesake project and the recently acquired Mile 72 project in Namibia,” he added.