More pain for vehicle dealers, owning and operating a car increased by 15.5% in a single month

Annual inflation is right back where it was a year ago, relentlessly pushed higher and higher every month by a combination of rising fuel prices and a depreciating South African Rand. A year ago, however, the trend was downward while this year for the past six month, the trend is upward.

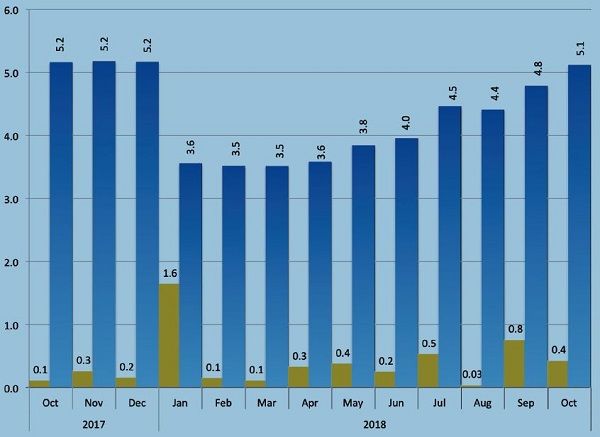

Annual inflation measured monthly, came in at 5.1% for October, a mere tenth of a percentage point less than the 5.2% growth in October last year. The five consecutive rises in petrol and diesel prices contributed most to the growing inflation rate, increasing by a whopping 13.6% and adding more than 35% of the 5.1% increase.

Upon releasing the latest consumer price index, the Statistician General, Mr Alex Shimuafeni said “The highest contributors to the October 2018 annual inflation rate were Transport (35.3 percent), Housing, water, electricity and other fuel (21.3 percent), Alcoholic beverages and tobacco (13.2 percent) and Food and non-alcohol beverages (10.5 percent). The rest of the groups contributed 19.7 percent all together.”

“The annual inflation rate for the Transport group for October 2018 stood at 13.6 percent compared to 4.4 percent registered in October 2017, resulting in a significant increase of 9.2 percentage points. The increase resulted from increases witnessed in the price levels of the sub components of Public transport services which increased from (0.0 percent to 18.0 percent) and Operation of personal transport equipment which increased from (4.7 percent to 15.5 percent),” he elaborated.

Headline inflation has been growing steadily since May this year after it plateaued around 3.6% from January to April. Annual inflation measured monthly was at its highest last year January at 8.3% and at its lowest in February and March this year at 3.5%.

Second round effects are now coming into play as a result of the increase in fuel prices. Namibia imports around 80% of its consumables by road from South Africa indicating that the 17% rise in transport costs since May this year will still percolate through to a very large part of the retail sector.

On a month on month basis, the rate of inflation has slowed from 0.8% to 0.4%.