The October inflection point has just been confirmed by the continued momentum in the November Business Monitor

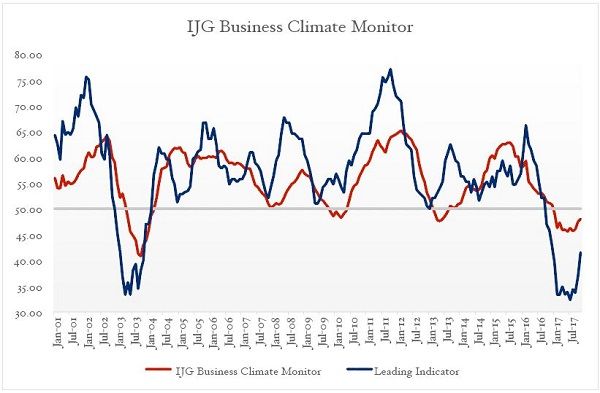

The IJG Business Climate Monitor for November 2017 has confirmed the October inflexion point which was only tentative at that time.

This metric is the first that I am aware of that has shown improvement two months in a row. What is also very encouraging is that both months are still part of the fourth calendar quarter of 2018. This does not automatically mean it will be a growth quarter but it does reinforce a rational expectation for a positive quarter.

There is quite some distance between the Business Monitor as an index with a leading component and the quarterly GDP data compiled by the Namibia Statistics Agency, which is based on historical performance.

But let me put the mic in the compilers’ own hands, to get a feel of their take on the positive change in economic direction,

“At the close of November 2017, the IJG Business Climate Monitor continued its upward trajectory. An increase of 0.54 points was recorded for November, bringing the index to just over 48 points. The leading indicator climbed a healthy 4.7 points after a 3.6 point increase in October. This suggests that the economy is still in a contractionary period, although it is contracting at a slower rate. Should this trend continue, it points to growth in 2018.”

“Of the 31 indicators measured by the index, 18 increased during November, while the remaining 13 deteriorated. Commodity prices remained flat – except uranium, which saw an increase of 16.5% to US$23.25 (well below the price required by domestic mines). On a 12-month basis, uranium, copper and gold prices have seen growth (of 31%, 9% and 16% respectively), which is encouraging for the long-term outlook of the industry. Credit extended to individuals continued to subside, particularly instalment credit, which is reflected by the trend in slowing vehicle sales. On a more positive note, approvals in building plans increased by over N$80 million in November.”

These two paragraphs pirated from the Monitor, to my mind, provide a fairly reliable overview of conditions at the end of 2017, and by implication, what we can expect for 2018.

Elsewhere in this edition, we quote the work of BMI Research on macro-economic trends. The reason I am mentioning that here is because their metrics and their view are somewhat opposed to the results of the Business Monitor.

BMI reminds us that the loan-to-deposit ratio is still a very neutral 1.00. This does not bode well for private sector credit extension since a lower deposit rate hampers banks in their ability to extend new credit mostly due to statutory and regulatory issues. However, all banks have very healthy capital adequacy ratios for both Tier 1 and Tier 2 capital. This in turn implies that they can actually extend credit faster, if they want to slacken their very tight credit risk profiles only slightly.

In earlier commentaries I have pointed out that the very improved bank liquidity does not seem to find its way into the real economy and is instead parked in the low-risk environment of the capital market.

This sentiment probably originates from the banks’ view on investment and productivity. I was actually told this by an individual who is responsible for risk management at one of the local banks, who said their own exco is divided over how fast a more realistic credit extension trajectory should be pursued by local banks.

This has to a large extent to do with the lack of up-to-date data, and dependable economic performance statistics. What the bankers told me in a roundabout way is that they are keen to grab loan opportunities more aggressively but are held back by a skepticism that the tentative indications of an economic rebound, are at this stage still only tentative. They were looking for a clearer signal.

I believe the November IJG Business Monitor this week provided that signal. The change in the index has now been confirmed and it is unlikely that it will re-assume a negative trajectory. Although the index is not yet above the neutral 50 points, it is so close that only a slight positive change in any of the underlying components is required to go above 50. Even if there is no dramatic change in any single components, if only two of the still-contracting components turned positive in December, there is a reasonable chance that we finally are in positive territory.