Said the mouse, “Excuse me Mr Elephant, but you are standing on my tail!”

The local index on the Namibian Stock Exchange jumped 16.41 index point in a single day on Wednesday.

This is a daily move of almost 4%. The local index closed Tuesday on 413.98 and by end of trade on Wednesday it has surged to 430.39.

Going into the detail of what drove this massive jump is not that straightforward. The day’s trading consisted of eight deals in five of the eight local listed companies.

The biggest activity was in Oryx Properties which saw 84,481 shares traded to a value of N$1,563,743 in three deals, but the share price was unchanged, so these deals could hardly have any effect on the index.

Next up was Namibia Breweries with two deals trading 26,756 shares to the value of N$538,866 but the Breweries share price actually went down by two cents, meaning these two deals could also not have contributed to the local index jump.

There was one deal in Stimulus Investments preferentials, one deal in FNB Namibia Holdings and one in Bidvest Namibia. But these three deals traded share volumes of 432 in Stimulus, only 200 shares in FNB Holdings and only 180 shares in Bidvest Namibia. Respectively these three trades registered values of N$52,397 for Stimulus, N$6402 for FNB Holdings and N$2320 for Bidvest Namibia. None of these deals were sufficiently large to exert such an influence on the index.

The only significant share price movement was for FNB Holdings where the share appreciated from N$27.41 on Tuesday to N$32.01 on Wednesday. But again, a trade of just over N$6000 for only 200 shares can hardly shuffle the rest of the index that much.

Trying to get behind the index’s constituent elements, at some point I entertained the idea whether this was not a classic April Fools joke from the NSX staff. But I buried this idea considering how serious their business is and what unfathomable ramifications will ensue from a false report.

It reminded me that I will have to take up with the NSX the issue of their methodology. If indeed, they follow a trade weighted regime, then the total trade value of N$2,163,729 constitutes 4% of total local market capitalisation. A simple calculation then shows me the total local market cap must be about N$54 million which is nonsense. The NSX Daily Report indicates Total Free Float Market Cap as N$7.8 billion.

Despite my inability to come to grips with NSX index methodology and my lack of a formal statistics foundation, looking at the trading figures and the market cap, I realised what a puny economic contribution comes from listed companies. If I accept the bona fides of the daily statistics, it shows me the government is the economic elephant in the room and is set to remain so for several decades. This is not a good state of affairs. If Namibia’s GDP is approaching N$165 billion it means the publicly tradeable part of the private sector constitutes less than 5% of the overall economy. This is also not a good state of affairs. First and foremost it clearly show that there is zero liquidity in the local market.

Secondly, if the government plans to spend some N$67 billion over the next year, then it alone is just over 40% of the economy. This is very worrisome. In itself, the government is eight times bigger than the NSX’s entire market cap as far as the local index goes. This is perhaps the biggest reason for concern. In a liquid, mature market, the value of the companies on a stock exchange must be about ten times bigger than the government’s contribution, not the other way round.

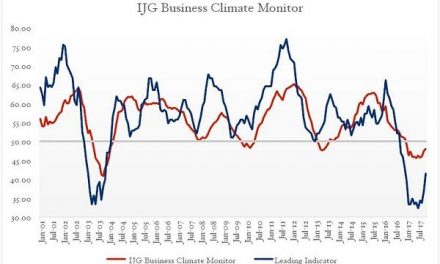

When we look at our development curve, a few superficial statistics clearly show the type of distortions we are dealing with. I am realistic about the rate of development but I am equally realistic that we shall have to start work on slowly, gradually, perhaps over a 20-year period, rebalancing the economy. When the government controls the economy so overwhelmingly, crowding out is the next step and I will not be amazed if that has already happened in many sectors.

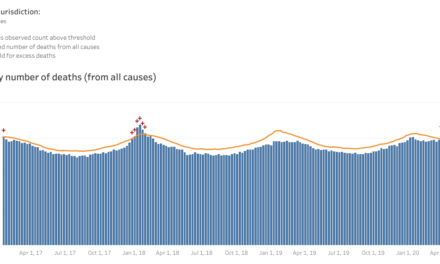

From a development point of view it is good that a strong unified entity like the government drives the economic expansion, as we have been doing since 2010 but in any such scenario, there must be an escape plan, which I doubt there is.

When one public entity is so much bigger in size than the local tradeable market, it also manifests risks of the same magnitude. What it will mean for us is that a single exogenous shock, like a collapsing currency, or ballooning public debt, poses the risk of completely derailing the economy as a whole, ala Zimbabwe. When the private sector is too small to drive economic growth in any meaningful way, the future is not all that rosy.