Vehicle sales growth slows down

Figures released this week by the National Association of Automobile Manufacturers of South Africa (NAAMSA) shows that overall new car and commercial vehicle sales for the month of March registered modest gains compared to the corresponding month last year.

Aggregate Industry sales improved by 2 552 units or 4.8% to 56 110 vehicles from 53 558 units in March last year. New car sales in particular registered relatively strong gains while export sales remained under pressure.

Out of the total reported Industry sales of 53 300 vehicles (excluding Mercedes-Benz South Africa), 89.0% or 47 417 units represented dealer sales, 4.9% represented sales to government, 3.1% represented sales to the vehicle rental Industry and 3.0% to Industry corporate fleet sales.

At 38 970 units, total aggregate Industry new car sales during March 2012 reflected an improvement of 3 802 units or 10.8 % compared to the 35 168 new cars sold during March 2011. Car rental Industry sales which had been particularly strong over recent months, only accounted for 3.8 % of total new car sales during March 2012.

Including estimates for MBSA commercial vehicle sales by segment – sales of Industry new light commercial vehicles, bakkies and mini buses at 14 556 units reflected a decline of 1 183 units or 7.5% compared to the 15 739 light commercial vehicle sales during the corresponding month last year. Sales of vehicles in the medium and heavy truck segments of the Industry at an estimated 934 and 1 650 units respectively, had recorded a decline of 22 units or 2.3%, in the case of medium commercial vehicles, and a fall of 45 units or 2.7%, in the case of heavy trucks and buses, compared to the corresponding month last year.

At 23 956 vehicles, exports of South African produced motor vehicles, including MBSA export sales, reflected a decline of 6 070 units or a fall of 20.2% compared to the 30 026 vehicles exported during March last year.

Industry export sales should improve during the months ahead as the Ford Global Compact Vehicle Export Programme and the BMW new 3 series export volumes are ramped up. Vehicle exports into Europe softened as a result of the debt crisis in the Eurozone.

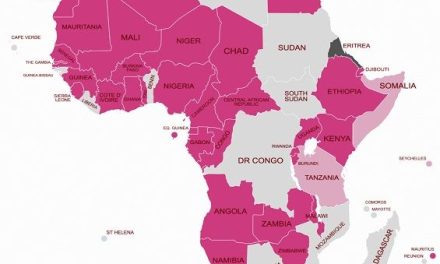

The Industry’s export performance during 2012 would remain a function of the direction of the global economy. Higher export volumes to African countries however are anticipated.