Don’t know if you have noticed, but the expansionary feast is over

Once the dust and hot air have settled around the new budget, it becomes time to tackle the voluminous documentation that supports the budget process, to dissect, weigh, and deconstruct.

On the macro side, the budget shows a remarkable change in direction from the previous five years.

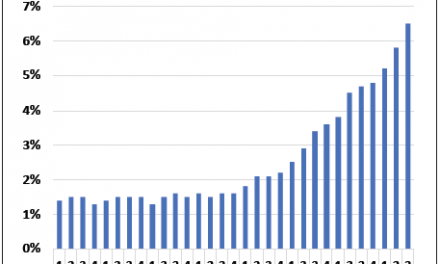

The so-called counter cyclical budgeting started under the previous finance minister in the 2010 fiscal year after the rather disastrous 2009 when the economy shrunk by 1.1%. This expansionary approach morphed into TIPEEG which lasted three years and came to an end last year February. But the expansionary fiscal programme did not end there and continued unabated for the 2014/15 fiscal year. If there is any doubt about the veracity of this statement, take the concise budget on pages 594, 595 and 596 of the latest Medium Term Expenditure Framework and start crunching the numbers.

What it shows is that the 2104/15 fiscal year display all the elements of the tail end of an aggressive stimulus that stretched over five years. Estimated growth in the revenue and expenditure components reflect values of around 25% upwards. This explosive growth is however not mirrored by GDP and debt. The total debt stock grew by a modest 17% and GDP expanded by just over 14%. Note that these statistics are still estimates and will only be finalised towards the middle of this year once all the data has been received from all the ministries and agencies, for all the regions.

Now fast forward to the Medium Term Expenditure Framework that started just over a week ago. Unravelling the budget framework for the next three years reveals a far more conservative approach to public finances. For 2015, 2016 and 2017, the economy is planned to grow by around 10% every year.

This is in nominal terms and we shall see only later what real growth that generates. But the fundamentals of the published estimates clearly show that we are migrating from a 15% nominal growth regime to a 10% regime. This is a reduction of roughly one third.

Just as the impetus created by the five expansionary years have lead to an ever stronger wave of economic expansion resulting in the sterling growth of last year, so I believe the effect of closing the tap will also take more than just one year to manifest itself, but eventually it will.

When a financial authority decides to slow down growth there must be sound and compelling reasons for doing so. Perhaps the most convincing point lies in the debt explosion that we are witnessing. Contrary to the GDP, Revenue and Expenditure components for 2015, where an expected slowdown is obvious, our national debt stock is budgeted to explode by 36% this year. Over the five-year period from fiscal years 2013 to 2017, the debt Namibia has to carry, will have more than doubled.

Given our track record for under-budgeting, there is a reasonable chance that the debt, expressed as a fraction of GDP, will not reach and exceed the 32% level as envisaged.

But this only holds true if the overall economy expands at the foreseen rate. This may or may not be so. When it was policy to expand the economy, it becomes easy to predict outcomes after a number of years.

Since we have changed direction, now moving into a more conservative 10% nominal growth framework, we have introduced variables of which the outcomes will only be clear in about 24 months. After that, it should be easy again to predict and determine the outcomes of future budgets, provided we do not change track again, and move back to aggressive stimulus.

There is also a chance that in two years from now, it transpires that the braking effect of reduced government intervention, has actually slowed economic growth more than anticipated. If that happens, of course, the debt ratio will climb, even if the nominal debt does not reach the lofty heights planned for.

I have to admit, it was a bit of a scary revelation when the budget framework clearly showed me we are moving into a slower growth period. Think of all those building projects which have carried both the national budget and a large chunk of the tenderpreneur clique and imagine what a slowdown in government spending will to do their income statements.

Or it may simply be a case, as I sincerely hope it is, of the government sitting back, now asking for some return on investment from the private sector, after it has dumped so many millions into the economy.

Although unsaid, I deem it fair that public finances reign in the spending glut, demanding that the private sector step up to the plate, and start contributing its fair share to future growth.