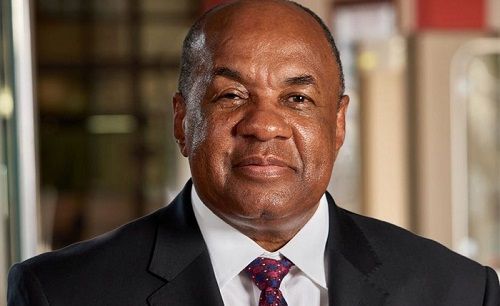

!Gawaxab advocates economic resilience and financial innovation at 2024 Cirrus Investor Conference

The Bank of Namibia Governor, Johannes !Gawaxab addressed the 5th edition of the Cirrus Investor Conference in Swakopmund from 9-10 April, championing economic resilience and financial innovation in the face of global challenges.

The conference brought together stakeholders in development finance institutions, institutional asset managers, listed companies, state-owned enterprises, and various government bodies, to facilitate connections between Namibian securities issuers and potential investors worldwide.

In his opening address, !Gawaxab delved into the complex forces shaping Namibia’s economic trajectory and financial outlook. Amid geopolitical tensions, climatic fluctuations, and the ongoing energy transition, he underscored the Bank of Namibia’s unwavering commitment to price and financial stability.

Highlighting key initiatives to modernize the financial system, he emphasized the need for proactive measures to navigate unprecedented global challenges.

Addressing concerns over stubborn inflation, he provided insights into Namibia’s inflationary trends, citing average rates of 2.2% in 2020 and 3.6% in 2021, which surged to 6.1% in 2022 and 5.9% in 2023. He stressed the importance of robust policy-making to mitigate uncertainties and anchor inflation expectations, prioritizing stability for the well-being of Namibians.

Looking ahead, !Gawaxab outlined projections for a modest economic slowdown in 2024, followed by a rebound in 2025, driven primarily by agriculture and mining.

!Gawaxab also highlighted the recent launch of the Bank of Namibia’s Annual Report for 2023, underscoring the institution’s commitment to transparency and accountability. Amidst a high-interest-rate environment, robust financial performance enabled the declaration of a dividend exceeding half a billion Namibia dollar to its only shareholder, the Namibian Government.

In alignment with its Strategic Plan, the Bank of Namibia remains steadfast in its mission to drive digital and financial inclusion across all sectors of Namibian society. Initiatives such as the Instant Payment Solution, the Central Securities Depository (CSD) Project, and the exploration of Central Bank Digital Currencies (CBDCs) are pivotal in modernizing the financial landscape and fostering greater inclusivity.

The introduction of the Instant Payment Solution promises to revolutionize financial transactions, particularly in rural and informal sectors, enabling instant and secure transactions without the need for physical travel or costly intermediaries. Moreover, the establishment of Namibia’s first CSD marks a significant milestone to enhance trading efficiency and attract global investors.

!Gawaxab’s advocacy for CBDCs reflects the Bank’s commitment to embracing innovative solutions for enhancing payment systems and promoting financial inclusion in the digital age. As part of the Common Monetary Area (CMA) countries, Namibia is actively exploring the potential of CBDCs in modernizing cross-border payments.

Addressing concerns over international standards compliance, he reaffirmed the Bank’s commitment to safeguarding the financial system, despite Namibia’s recent grey-listing by the Financial Action Task Force (FATF).

In concluding his remarks, he emphasized the imperative of a novel approach in navigating the unprecedented challenges and untapped opportunities facing Namibia. Calling for clarity in objectives and transparency in communication, he advocated for a bold departure from conventional thinking to embrace innovative solutions for the benefit of Namibian businesses and the nation as a whole.