Recently introduced Acts prioritise the stability of the financial system – Central bank

The central bank is prioritising financial system stability while promoting financial inclusivity and transformation in Namibia through the recently introduced Acts.

Namibia has modernized its banking sector with the Banking Institutions Act, 2023 (Act 13 of 2023) and the Payment System Management Act, 2023 (Act no. 14 of 2023), resulting in more efficient services.

These laws have introduced a world-class regulatory and supervisory system, demonstrating the country’s commitment to delivering responsive and transformed banking services.

According to a statement released this week, the Bank hosted a forum introducing its supervisory approach attended by senior executives of banking institutions and conglomerate groups in Africa.

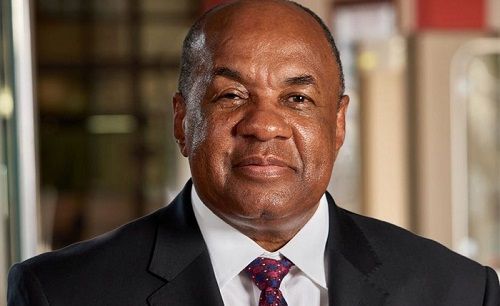

The Governor of the Bank of Namibia, Johannes !Gawaxab enthused that the new laws represent a watershed moment for the industry as it morphs into a future-fit operating model in line with the aspirations of a financial system that works for the Namibian people.

The new regulations require Namibian banking institutions to have independent and autonomous Boards that oversee effective governance, transparency, and accountability which is essential for a stable and sound financial system. Effective board succession plans should prioritize term limits and age to prevent board members from overstaying while ensuring proper oversight in line with the fiduciary function of the Board of Directors.

Furthermore, the new regime is predicated on embedding local decision-making in the best interest of the Namibian people, who have been loyal patrons of banks and have helped them thrive over the years as successful businesses.

In this regard, credit decisions and approvals should be done by persons the Bank of Namibia has authorized and found fit and proper locally. No credit decisions should be taken outside Namibia by persons neither authorized nor found as fit-and-proper by the Bank to run the affairs of a Namibian banking institution, !Gawaxab said while cautioning that the sector needs to be responsive and transformed to avoid collision with Namibian society.

“Our financial system is on a proverbial fork road. Operating models that achieved success in the past, may not do so in the future. I believe this new regulatory and supervisory framework, the Bank, as regulator and supervisor, and the entire industry shall work in tandem to bring about a responsive and dynamic financial ecosystem that maximizes shareholder value while serving the national interest. I count on all stakeholders to support us in this worthy endeavor,” he concluded.