Are Namibian bonds still considered a good investment despite current market conditions?

By Arney Tjaronda

Analyst at High Economic Intelligence.

Looking at the publications by the Bank of Namibia (BoN) and Namibian Stock Exchange (NSX) during June 2022, the majority of sovereign government bonds were oversubscribed by the public while equities faced gruesome, bearish market conditions.

There is a phenomenon to be revealed to comprehend the narrative of how the current geopolitical tensions, inflation, rising interest rates, and decisions made by the credit rating agencies impacted government bonds.

Usually, bonds are a good investment vehicle in a bear market because of their hedging properties. Defining a bear market, it generally means that prices are going down and there is a lot of pessimistic behaviour from market participants. When faced with a pessimistic market behaviour, it results in the selling-off of shares, ETFs, and any other vehicle which might be negatively impacted by the bear market.

Thereafter, market participants search for ‘hedgeable’ investment instruments like commodities, bonds, and crypto-currencies to prevent them from losing money in the stock market when prices are falling. Based on FRED’s data for the last 20 years, bonds and equities have been perfectly (positively) correlated.

This entails that when the prices of all listed equities fall, the subscriptions of the bonds increases and this is due to the risk involved. Bonds are less risky than equities because they pay a fixed rate of return whilst equities have no fixed rate of return as returns are not limited. Also, they are less volatile depending on the economic environment.

Following the geopolitical war between Russia and Ukraine; the rising interest and inflation rates, escalating oil prices, and the fears of a potential global recession have changed investors’ perceptions, making bonds more desirable than to help hedge against the meltdown in the equity markets.

Unfortunately, the Flitch credit rating agency downgraded Namibia’s outlook from stable to negative. The downgrade from Flitch’s credit rating agency primarily affects the yield on bonds and consequently portfolios with a large bond holding. A downgrade also means that the government bonds are at much more risk than they were before, therefore, bondholders will try by all means to rearrange their portfolios to hedge the risk associated with the bonds as they fear a likelihood of a credit default.

The Bank of Namibia (BoN) increased the repo rate to 4.75% on 15 June 2022, a move that caused a wave of unhappiness from the public, particularly for individuals planning on acquiring property and those who are already servicing their mortgages. This action also impacted the government as they have to service their debt instruments resulting in them paying more than the standard installments.

For investors who are already subscribed to bonds, the bond’s interest payments or coupon rate is related to the prevailing interest rates in the economy. Since most bonds have a fixed coupon rate, they are assumed to remain constant despite any fluctuations in the market interest rates. When interest rates rise, new bonds that are issued have a higher coupon rate and thus provide more income to the investor.

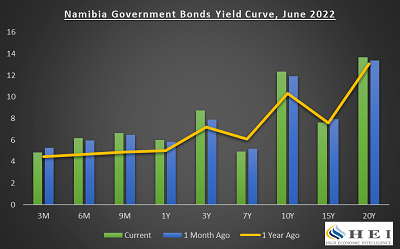

Considering the data from the World Government Bonds Index (WGBI), Namibia’s 10-year government bond has a 12.17% yield, whilst South Africa’s 10-year government bond has a 10.60% yield. One can analyze that Namibian government bonds are more desirable than South African bonds, perhaps this explains the growing demand for Namibian bonds.

The scrutiny could be raised as some investors will debate the risk perspective on the debt sustainability of the public debt, but this depends entirely on the risk tolerance of their portfolio. However, it was an astonishing discovery that in June 2022, the Namibian bond market performed better than the equity market in terms of subscriptions. According to a newspaper article written by Lazarus Amukeshe, investors in Namibia have offered to subscribe to a whooping amount of N$27 billion, while the government asked to raise N$665 million, constituting an oversubscription of N$816 million (379%).

Unfortunately, this was not the case for the equity market where N$438 million worth of shares were traded during that period. These trades make up activity from the local and overall bourse. Approximately 18 out of 32 respective listed companies’ shares on the NSX were sold off by investors in fear of enduring the risk of losing their invested capital, indicating that up to 60% of listed companies averaged a loss of 19.79% during the period under review.

Lastly, Warren Buffet (1985) once expressed the rules of investing being: “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.” Investors in Namibia are prone to use the low risk/moderate-high return strategies in their portfolios, hence why government bonds are captivating during this time. They need to adhere to the Investment Policy Statement (IPS) of their clients to determine the risk profile, tolerance, and required returns, but this is a conversation for another day. In conclusion, bonds are the ‘haven’ investors need to hedge risks while generating alpha.