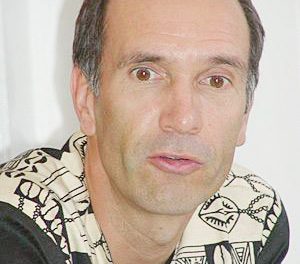

Oryx targets 40% gearing ratio

NSX-listed real estate company, Oryx properties has set a target of a 40% gearing ratio by mid next year, the Economist has established. The Chief Financial Officer of Namibia’s biggest property company by market capitalisation Carel Fourie told this newspaper on Thursday that the company has set its sight on reducing its debt levels in line with industry levels. Oryx’s gearing ratio peaked at 50% when the company acquired the Gustav Voigts Centre from Tuinweg Investment Properties in a deal worth N$220 million funded through a N$250 million debt from Nedbank.

The debt from Nedbank comprised of a N$110 million revolving credit facility and a five-year term loan facility of N$140 million. As part of the agreement with Nedbank, the bank will now become the preferred funder of Oryx’s future ventures. Fourie said part of the funds from Nedbank were used to retire existing “expensive” debt from South African commercial banks. Although he gave no figures, Fourie said it made sense to replace the existing debt with cheaper debt from Nedbank adding that this will help reduce the gearing ratio to below 40% at the end of the current financial year on 30 June 2014. As part of its strategy of lowering the gearing ratio, Oryx recently concluded a N$170 million rights issue offer which the company said was oversubscribed. The rights issue offer opened on 28 October and closed on Friday 15 November 2013. The equity raised has so far brought the gearing ratio down to about 41%. Oryx is currently expanding and refurbishing its flagship property, the Maerua Mall Shopping Centre at a cost of N$350 million funded through debt. The company is also looking at developing properties in Walvis Bay and “one or two” possibilities in Ondangwa. “Nothing is firm yet but we are very much chasing some opportunities,” Fourie said.