How much do you need to save for retirement. Tips on Saving Part 5

You should aim for a retirement income of 75% of your final salary. Here’s why …

The million dollar question: How much of my income do I need to save?

Of course we would all love that answer. After all, humans prefer certainty. We have an aversion to ambiguity and will do whatever we can to get answers. Psychologists have researched this phenomenon, concluding that our need for answers can influence our choices. The trouble with answers to personal questions is that even well-researched answers refer to averages and generalisations. It is important to take your personal needs and goals into account when putting your financial plan together. It is worthwhile talking to an independent financial adviser who can look closely at your circumstances and give you tailored advice.

Aim for an income of 75% of your final salary

It is widely held that a retirement income equal to 75% of your final salary will allow you to live comfortably during retirement. This figure accounts for the adjustments many people make as they age, for example, no further retirement fund contributions but higher medical costs.

To assess how much you will potentially need, consider the following factors:

• Housing. Do you expect to own your own home when you retire having paid off your bond? If so, you can remove home payments from your budget. If you expect to buy or rent a bigger home between now and when you retire, you’ll need to increase your allocation for housing.

• Transport. Will your car be paid off or are you planning to buy an expensive car that will need to be paid off during retirement?

• Medical expenses. As you get older, your doctor’s visits, medication and medical aid contributions are likely to start increasing. In addition, medical inflation is usually higher than the average inflation.

• Education. Will you still need to pay your children’s or grandchildren’s school fees? Education inflation is typically around 4% higher than the average inflation.

Aim to put away at least 17% of your salary from age 25.

Assuming that you will be comfortable living off 75% of your pre-retirement salary, our research indicates that saving 17% of your salary is a reasonable starting point for the 25-year old saver. This amount increases dramatically the later you start. You need to save 22% if you start saving at 30, up to 42% if you start at 40, and up to 59% if you start at 45. It is important to note that these numbers are simply averages and assume a consistent, inflationary salary increase each year, that you retire at 65 and that you earn an average return of consumer price inflation (CPI) plus 5%.

Remember to account for lifestyle inflation.

These guidelines won’t work for you if your personal inflation rate, the rate at which your lifestyle improves, is higher than the Consumer Price Index, i.e. regular inflation.

A spike in salary, or above-inflation increases each year, affords you lifestyle improvements such as a bigger house, but may set you back in your provision for retirement.

Instead of continuing to invest at the same percentage of your new salary, you will need to ramp up your savings rate if you want your retirement income to fund your current lifestyle. Alternatively you will have to postpone retiring.

Each dollar that you spend on a better lifestyle is a dollar you will get used to spending, and thus need to fund from your retirement income when you stop working.

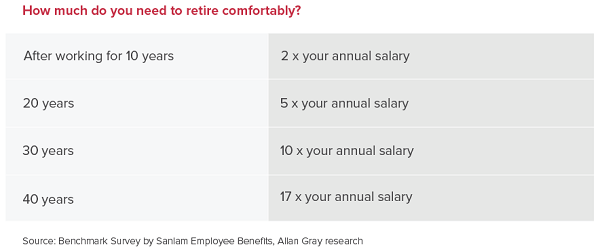

Check if you are on track to meet your goals:

Do this simple dipstick test to find out if you are on track to meet your goals. Don’t panic if you are not… in our next article of this series we will give you some practical tips about what to do to improve your situation.

Answer these questions and then consult the table below to figure out if you are on track:

1. What is your current salary?

2. How much have you saved for retirement?

For more information and assistance contact Allan Gray Namibia at [email protected] or visit www.allangray.com.na or call 061 221103.

This article forms part of a series.