Transport price inflation shifts out of reverse gear

By Gerrit van Rooyen

NKC African Economics.

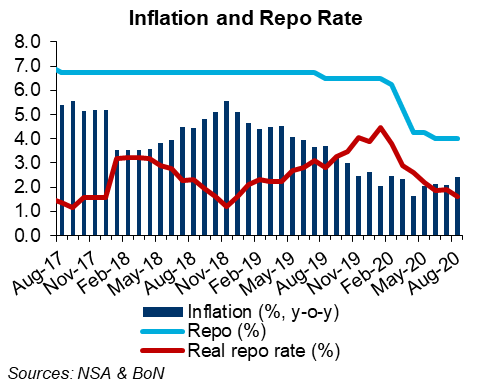

Inflation ticked marginally higher to 2.4% y-o-y in August from 2.1% y-o-y in July according to the latest consumer price index (CPI) report.

Looking at the major sub-indices, the food and non-alcoholic beverages (+1.2 ppt) and alcoholic beverages and tobacco (+0.5 ppt) sub-indices were the biggest positive contributors to the headline inflation rate, while housing and utilities (-0.4 ppt) was the biggest negative contributor.

Furthermore, the smaller miscellaneous good and services and education sub-indices each contributed 0.3 ppt. Some food prices pressures increased on an annual basis, mainly steaming from bread, cereal, fruit and fish costs.

Also, transport price inflation shifted out of deflationary territory as petrol price rose last month, recording 1.2% y-o-y in August (compared to -1.2% in July). Meanwhile, rental and electricity and gas prices kept the housing and utilities sub-index in deflationary territory.

The average inflation rate is expected to moderate to 2.4% in 2020 from 3.7% in 2019, due to lower oil and grain prices as well as dismal domestic demand, while pass-through from the weaker exchange rate is expected to be limited.

Transport price inflation has decelerated sharply after the benchmark oil price hit a peak of N$86pb in October 2018, and is expected to remain muted as we forecast an average Brent oil price of N$43.9pb this year, down from an average of N$64.4pb in 2019.

Despite acute currency weakness over the past year, pass-through has been limited, with retailers unable to pass on higher costs in the recession-hit trading environment. The outlook for both South African maize and global wheat production in 2020 is positive, which means Namibia’s bread and cereal price inflation should remain under control.

Moreover, housing and utilities price inflation has been subdued, as house and rental prices have fallen following several years of soaring growth. The coronavirus crisis will likely increase unemployment, which will put further strain on the housing market.