Housing index implies property bubble was driven by mortgages

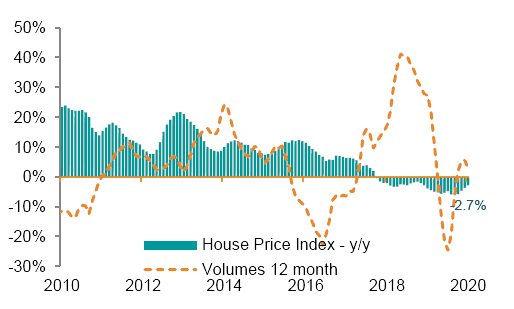

The rate of contraction in house prices is seemingly slowing down. The House Price Index in the FNB Residential property report, recorded a contraction of 2.7% for the quarter ended June 2020 whereas in the comparable 2019 quarter, the contraction was 3.7%. At the end of the first quarter of this year, the annual contraction was at its highest at 5.6%.

For the quarter ended June 2020, house prices contracted by 10.8% in the central region and by 13.8% in the southern region.

Despite the overall contraction, house prices in the northern and coastal regions grew by 6% and 8% respectively. This was the first time in 28 months that northern house prices rose. The northern regions are also the only area where volumes grew, posting an annual increase of 16.5%.

The overall tempo of land delivery also increase from a contraction of 22% a year ago to growth of 23.1% for the quarter ended June 2020.

FNB Market Research Manager Frans Uusiku said “The elevated demand for land in the central region led to a 12-month average price growth of 14.2% per square metre at the end of June 2020, compared to a contraction of 13% recorded over the same period of 2019. This can be ascribed to high bid prices offered for the purchase of land mainly by private developers.”

Following the release of its report this week, FNB said in a statement, it believes that the downward trend has passed its lowest point.

House prices have only registered an annual compound growth of 6% since 2009, which is lower than the 9% growth in mortgages over the same period. Also, there is a 91% positive correlation between house prices and mortgages since 2009. “This could imply that house price appreciation since the 2008/9 global financial crisis was associated with a corresponding growth in mortgages.”

“In conclusion we believe that attractiveness of the residential property market as an asset class will be dependent on the extent of economic recovery and subsequent revival of the rental market. In the meantime, we see accessibility and affordability of housing to be highly concentrated within the small housing segment particularly in the northern and southern regions. Looking ahead, immediate pockets of growth are likely to be realized through addition of new developments that respond to evolving levels of household incomes along with fact-tracking the pace of affordable land delivery.”