One ‘M’ too many or too few can sink the finance ministry’s aspirations of extending the bond maturity profile

This week’s switch auction did not exactly go as the Ministry of Finance planned. Not only did the auction produce only about half of the expected result, it was also marred by delays which may or may not have influenced investor sentiment.

The switch auction should have been a walk in the park. Since the Bank of Namibia has introduced this option for existing bond holders, it has proven very popular to investors and seldom did the switch amount not reach its target. As a matter of fact, in several of the switch auctions, the amounts tendered to be switched exceeded the amount offered nearly twofold.

The switch auctions are now an extremely important mechanism, not only for extending the maturity profile on the government’s long-term debt, but also as an instrument to bring cashflow relief to the fiscus when large redemptions are due. This would be the case with the GC21 bond, due for redemption on 15 October next year.

The upcoming switch auction was duly advertised by the Bank of Namibia and on Monday 03 August the yield announcement was made as scheduled. Now it was simply a matter for the responsible staff at the bank to prepare the auction on the Bloomberg trading platform but this is where the first glitch struck.

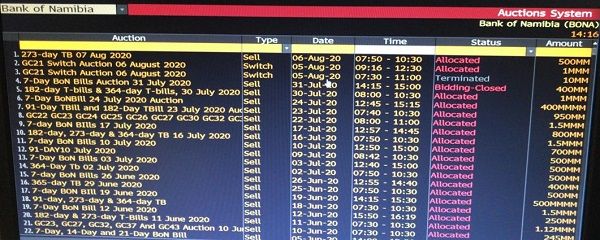

The amount offered must be entered in a specific format where M indicates thousands. So one billion is entered as 1mmm meaning one thousand thousand thousand (M stands for Mille – one thousand in Latin). As can be seen from the screenshot, it was entered incorrectly as 10mm or ten million.

It was only on Wednesday morning when bidders failed to submit their tenders that the bank got wind of the problem. At 09:54 the bank mailed the following to all participants: “We are experiencing technical difficulties with the Bloomberg setup. Bloomberg is busy looking on it. The Auction closing time will be extended by an hour and will close at 12:00. Apologies for any unconvinced cause. Will notify you soonest the issue is resolved.”

This is quoted verbatim so readers can judge for themselves whether the bank’s staff has a proper command of the English language, but that is not the issue. The kicker is that the bank had to ask Bloomberg to tell them what was wrong.

Now look again at the amounts in the righthand column in the screenshot. Notice the erratic amounts that are entered for several of the auctions. I mean, if the government can raise 500,000 billion in one auction, it can keep us going for a very very long time.

Nevertheless, it transpired that the problem was not a Bloomberg problem as the bank alleged but an in-house problem, one smacking of a lack of oversight. Also significant is the fact that the tender deadline was extended by one hour, seemingly at the discretion of a junior staff member. Later it was extended by another half an hour.

The prospectus for the switch auction is a fairly serious affair. It is rigorous in its description of procedures with dates and times stated unambiguously, and beware the bidder that misses one of these deadlines. But when the system falls over because of a booboo, somebody in the bank apparently has the authority to just shrug it off and extend the deadline. This sounds almost like, “ OK fellas, there was a problem. It seems to be fixed now. So lets play the game again, and by the way, forget about the previous deadline, here is a new one.”

The matter of the fact is that all bids would have failed with the offered amount of only 10 million and were it not for some of the early bidders noticing that their tender submissions failed, nobody would have been any wiser.

The cherry on top of it all is that the tender results were announced at a quarter to two but withdrawn and replaced by “revised” results at 15:23.

I do not know whether the hickups played a part in putting off investors but I feel sorry for the finance ministry that it received switch bids for only N$500 million where in fact it had targetted an amount of up to N$1 billion. I also feel sorry for the Bank of Namibia that in the end it was able to switch only N$417 million, especially given how well previous switch auctions went.