Recon Africa to commence drilling programme on Kavango Basin in June

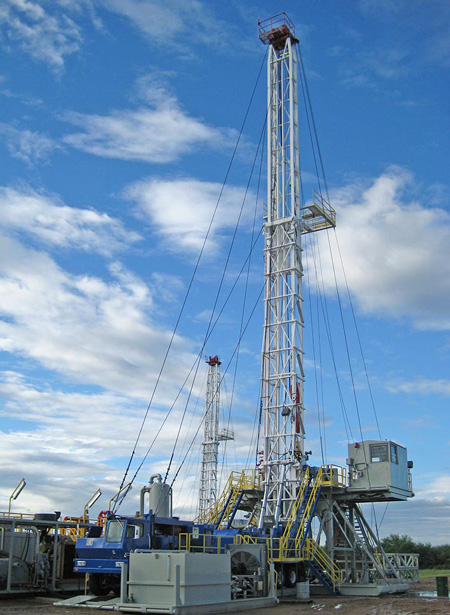

Namibian-based junior oil and gas company, Reconnaissance Energy Africa recently entered

into a binding Asset Purchase Agreement with Houston-based Henderson to for the acquisition of the Crown 750 drilling rig.

The rig, which has an initial cost of US$1.8 million (approx N$26.8 million), is anticipated to be on the first drilling location in the Kavango Basin by the second half of June this year from where the first test drills will commence on the newly found oil play.

As a result of comprehensive discussions with international drilling contractors, management concluded the acquisition of a company-owned rig is approximately 45% of the cost of hiring an international drilling contractor for its Namibian project.

Recon Africa stated by acquiring a rig located in Houston, there are significant time and cost benefits as the rig will be shipped directly by sea from the Port of Houston to the Port of Walvis Bay, Namibia. Once in Walvis Bay the rig will be transported over land by way of the paved highway directly to the Company’s Kavango Basin license area.

“We were able to acquire this high-quality rig at a significant discount of the cost to build, as it is truly a buyer’s market. This rig is very well suited to execute the Company’s initial program of drilling, logging and coring three deep wells in the Kavango Sedimentary Basin this year,” said Jay Park, CEO Recon Africa.

The Kavango Basin oil play is ranked second by www.oilprice.com as it has Karoo geology, and it’s also been shown to have the same depositional environment as Shell’s Whitehill Permian shale play, part of the Karoo Supergroup in South Africa.

Furthermore, Bill Cathey CEO and Chief Geoscientist of Houston-based Earthfield Technologies and a member of the Company’s Technical Advisory Team spoke to the prospectiveness of the Kavango Basin, affirming that “in my experience, I haven’t seen a basin this deep anywhere in the world, that hasn’t produced commercial quantities of hydrocarbons.”

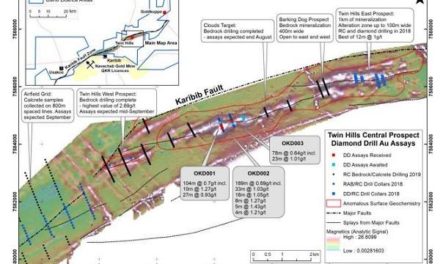

Recon Africa holds a 90% working interest in petroleum licenses comprising approximately 6.3 million contiguous acres in the Kavango Sedimentary Basin. The license entitles Recon Africa to obtain a 25 year production licence.