Where has all the liquidity gone?

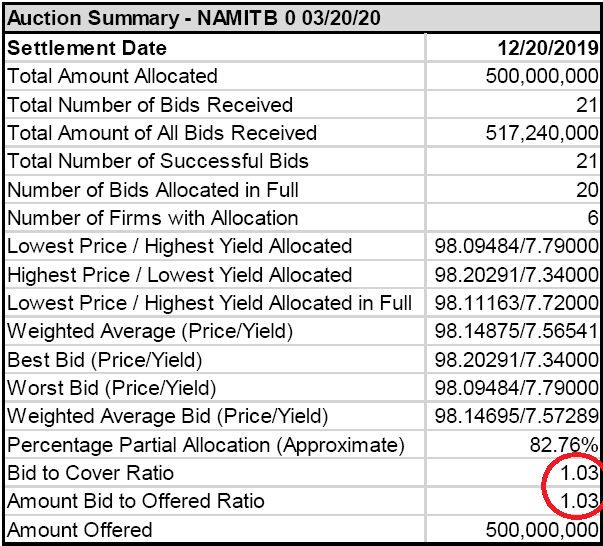

The first signs of strained liquidity in the capital market appeared on 20 November with the GC20 switch auction which set the target of swinging one billion dollars to longer dated instruments. This target was never reached, and the bidding was certainly not as lively as with the previous switch auctions.

With the switch auction the Ministry of Finance received bids for only N$784 million of which it could successfully allocate only N$648 million, roughly 35% below the target. On 29 November, some N$773 million of the GC20 was still outstanding and it was still trading in the secondary market this week. The D-day for the outstanding amount is 15 April next year.

More signs of strained liquidity appeared at the beginning of this month with the special auction on the 4th when the finance ministry tried to raise a whopping N$1.535 billion, an amount that would have been oversubscribed easily only two months ago, but which only collected N$1.159 billion.

Depending on the direction of the calculation, it can either be said that this auction performed 24.5% worse than anticipated, or that the ministry needs 32.45% more than what was raised. This, after all, is only academic but it can safely be stated that the special auction underperformed significantly, and the switch auction even more so.

Many investors in the capital market told me the two auctions were held to close together for such huge amounts. That may be so but remember that with the switch auction, no actual new transfers to government would have been made. As it were, the switch auction is only meant to extend the bond maturity profile over a much longer time frame to relieve the immediate pressure on the fiscus when bonds have to be redeemed.

In my mind the special auction was a far more dependable test of liquidity as it required new investment by the market participants. I was also told that there was some demand from investors for the special auction but the ceiling was estimated at around one billion dollars. This is a figure I can believe since it was supported by the auction’s results.

From the special auction, not only did I get the impression that there is a definite limit to what the local market can absorb, but I sense also that appetite is on the wane. This is most readily visible in the subscription rates.

At the standard Internal Registered Stock auction on 06 November, the amounts bid were still very healthy, with two of the bonds oversubscribed almost four times and even the worst not going below 1.6 times. However, things took a dramatic turn for the worse after this date but it was not immediately apparent.

On 15 November, the Bank of Namibia still said “The amount of N$450 million was scheduled to be raised on bonds (Fixed-rate & ILBs) on 05 December 2019. The government will raise an additional N$1.0 billion as a cash buffer to aid the Ministry of Finance in the effective management of the government’s cash flow.” (All the grammatical mistakes have been edited out – Ed.)

The N$450 million amount for the regular auction was reviewed that same day and increased to N$535 million, a 19% upward adjustment in less than 8 hours.

At that time, this conveyed a sense of optimism as if the capital market is insatiable. Then the special auction took place early in December with many of the lofty dreams shattered in its aftermath.

For the last two auctions, subscription rates have plummeted with several of the bonds fetching very few bids. Even the ever-popular Inflation linked Bonds have suffered, and TB’s, always a popular short-term parking bay, have seen appetite dwindling.

What is disconcerting is that not only the capital market is slowing down rapidly but also the money market. Here I do not want to go into all the detail, first because it is a volatile market, and second, when the consolidated monthly figures do become available, they are of historical value only.

Suffice to say, daily banking liquidity has more than halved since the middle of November and has come precipitously close to dangerous levels on a number of days. Furthermore, the uptake of BoN Bills (money deposited with the central bank) is now zero, and Repos (money borrowed from the central bank) has ballooned to well over N$1 billion.

I do not say that we are at a repeat of December 2016 but going on the hard evidence, I am certainly saying that we have come to the end of the road in terms of raising local liquidity artificially by increasing Domestic Asset Requirements. I can only hope that private sector initiatives like the bundled-bond ETF launched by Cirrus Capital recently, will entice foreign investor to take a second look at the local capital market. If they don’t, I foresee a serious liquidity crunch early in 2020.