Slight improvement in rental property but trend remains weak

The price for rental property is slowly recovering but is still expected to end this year some 3% weaker than last year.

According to the July 2019 rental index compiled by FirstRand Namibia, prices for rented properties are still contracting but at a much slower rate.

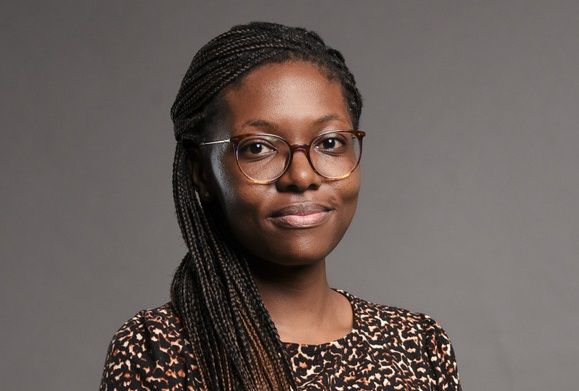

In the index report, Ruusa Nandago, FirstRand’s Market Research Manager, states that “with the House Price Index recorded at a 9-year low of -3.7% and the associated transaction volumes decelerating, the improvement in rental prices could be an indication that individuals are opting to stay in rental accommodation longer, as opposed to purchasing a home.”

“Consumers are highly indebted and this, combined with low wage growth, presents affordability issues which make renting a more attractive option,” she said.

The inflection point in the rental market was first noticed in May this year when data started fluctuating widely from values captured in the previous months, and during last year.

The report shows that advertised rental prices have continued to show signs of recovery, with the FNB Rental Index recording a smaller contraction of 3.1% y/y at the end of July 2019 compared to a contraction of 8.3% y/y recorded over the same period last year.

This improvement was supported by the more than 3-bedroom segment which has reversed its downward trend, recording growth of 1.6% y/y compared to a contraction of 4.8% y/y in July 2018.

But prices in the 1 and 3-bedroom segments are still contracting albeit at slower rates of 2.8% y/y and 3.3% y/y respectively. Prices have not changed in the 2-bedroom segment.

The average rental price for July was N$7220, down from N$7387 in May and N$7346 in May last year.

In the report Nandago notes that rental deposits are also coming down, and at a much faster rate than the rationalisation in the actual rental prices themselves.

“A severe contraction of 28.6% y/y [for deposits] was recorded at the end of July 2019 compared to growth of 15.7% y/y recorded over the same period last year. This is the largest contraction recorded since December 2017 and is observed across all Rental Index segments,” she said adding that smaller or zero deposits are used by landlords to make rental properties more attractive.

Nandago is of the opinion that renting will become more popular than buying because affordable housing is still unavailable for the majority of consumer whose disposable incomes are increasingly coming under pressure.

“Thus, we expect a continuous but slow annual increase in prices in the rental market. We are of the view, however, that growth in rent prices is unlikely to enter positive territory over the remainder of the year and likely to settle at -3.3% by the end of the year,” she said.

Rental yield, which provides an indication of the return from renting out a property, ticked up slightly to 7.7% at the end of July. This is the highest recorded since March 2018 but it is still below the rental yield ceiling of 10% proposed in the Rent Control Bill.