Deep Yellow resumes drilling programme on uranium tributaries in Tumas area

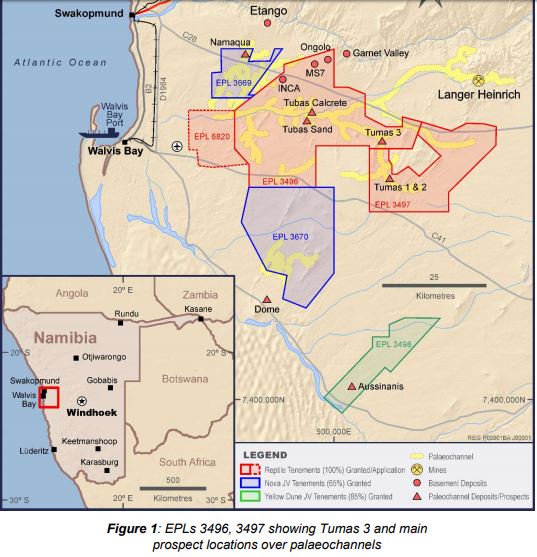

Deep Yellow Limited this week reported that it had recommenced with the drilling programme on the Reptile Project within EPLs 3496 and 3497 and held by its wholly-owned subsidiary Reptile Uranium Namibia.

The company on the SENS platform said the drilling has a two-fold focus: Follow-up resource drilling to test for resource upgrade of other specific uranium rich tributaries identified in the area east of Tumas 1 deposit and preliminary testing of a high priority palaeo channel zone at Tumas Central, west of Tumas 3 deposit.

The company said positive results returned from the July to November 2018 drilling programme confirming the high prospectivity of the palaeo channels as evidenced by the discovery of the uranium-rich seven channel tributary system identified in the Tumas 1 East area.

“Some of these channels that were followed up with resource drilling in November 2018 are the basis of a new resource estimate currently in evaluation and expected to be delivered late March 2019,” they added.

According to the explorer, drill line spacing on these priority target zones will be 100m to 200m drilled on 100m intervals. Drilling is expected to be of an average depth of 20 to 30 metres. This programme is expected to be completed mid-April 2019.

Meanwhile the drilling programme is continuing the exploration push to increase the inferred resource base of the calcrete type uranium mineralisation in palaeo channels to the target of approximately 100-150Mlb U3O8 in the grade range of 300 to 500ppm U3O8.