Private equity shifts sights to African markets outside South Africa

Over an eight year period from 2009 to 2017, the continental share of private equity transactions that went to South African companies has come down from 50% to only 31%.

According to the Bright Africa 2018 report, produced annually by RisCura, total private equity investment in Africa increased by 7% from 2016 to 2017 as fund managers continued to deploy the significant amount of capital garnered during the 2013 and 2015 fundraising years. At the same time, South Africa’s share of private equity gradually diminished.

Heleen Goussard, RisCura’s Head of Unlisted Investment Services and the principal author of the Bright Africa 2018 report said “Sluggish GDP growth, political uncertainty and increasing unemployment, all of which have been prevalent in the local economy for some time have caused investors to look for private equity prospects elsewhere.”

Risk versus reward is a key determinant of investment activity. Cost of equity is representative of the investor’s valuation of the risk that the enterprise is exposed to. RisCura estimates that the GDP-weighted Cost of Equity for the continent is 21% and has decreased in the current year by 0.35%.

For calculating the GDP-weighted Cost of Equity, Goussard used the real GDP estimate of BMI Research in the Fitch stable. Cost of Equity contribution per country equals GDP divided by the entire continental GDP and then multiplied by a specific country’s Cost of Equity.

“In 2017, most markets showed a decrease with Egypt & Sudan; Nigeria and Other West Africa being the only markets to record increases. Sudan’s current political instability and hyper-inflation drives the increase in that market, while Nigeria’s relatively small increase represents the final negative impact of the commodity cycle and the resulting currency devaluation.”

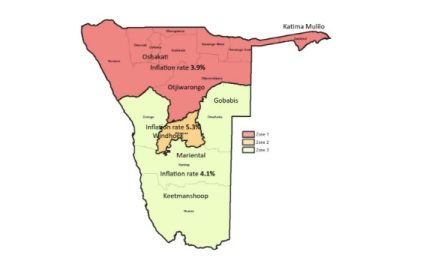

“Africa is not a single investment destination with a single set of standardised risk factors and homogeneous potential for reward. Segmenting Africa into meaningful markets is an important exercise,” said Goussard defending her methodology of dividing the continent into nine regions which she labels ‘meaningful markets’.

Although some high-level similarities are evident, digging down into the specifics of certain regions and countries shows that Africa comprises a range of distinct investment destinations; each with its own attractions, flaws, cultural differences and business practices.

“By analysing cultural connections, interconnectivity through trade blocs, sharing of expertise, good business relations, and relative ease of transportation, and the support a country receives from its regional partners allows investors to identify the long-term potential of an investment by better understanding the potential growth areas into neighbouring countries,” said Goussard.