Modest improvement in two key areas but installment slump got worse

The money and banking statistics for April, released on Friday 01 June 2018 by the Bank of Namibia continue to paint a rather bleak overall economic picture, but there are two small specks of improvement which stand out against the stagnant background.

The first is the healthy growth in mortgage credit to the private sector which rose by a not-insignificant 7.9% compared to April last year. This continues the rising trend which first started in February this year. The growth rates year to date are somewhat less than the comparable growth in the first four months of last year, but they come off the lofty tops of 2016’s first quarter when not everybody realised a major correction was already underway.

It is important to note that mortgage growth in 2015 and the first semester of 2016 was stellar. Although growth slowed down considerably in the second half of 2016, and throughout 2017, it remained positive, in other words, mortgage lending did not stop growing during the recession, it continued to expand only at a much slower pace. Unlike installment credit, it never stalled which would have been disastrous for the commercial banks whose loan books are carried in the order of 40% plus by mortgages.

It is also notable that the Bank of Namibia said the April growth was mainly due to a “rising demand for commercial property loans by the business sector.” This is indeed an encouraging sign. It shows that there is more momentum in the private sector than meets the eye. Mortgages are long-term commitments and were it not for a positive expectation of future business conditions, companies will be loathe to sign for long-term loans which they know will restraint their access to working capital if their anticipated growth does not materialise.

So regardless of what business confidence indicators show, there is sufficient evidence of confidence in a large enough slice of the private sector to merit their investments in property. Reciprocally, there is adequate confidence on the side of the banks to extend these loans which says a lot about current valuations compared to a year ago.

It will probably be a very long time before we see annual mortgage growth of around 15% like we had at the beginning of 2016 but it is important to remember that very few people at that stage realised there is serious trouble on the way. The fact that mortgage growth remained positive in 2017 and year to date in 2018, reflects in a sense, not only the underlying resilience of the broader economy, but also the important role of property investment for future expansion. After mortgages have grown by 15% for a period, it is almost impossible to maintain this growth rate. At some point, demand saturation sets in and the rate slows down but as long as it keeps growing, it shows confidence in the power of fixed capital investment to drive future operational expansion.

The second inspiring statistic is the marginal rise in Private Sector Credit Extension. It rose by 0.1 of a percentage point, definitely not a sterling move, but it provides tentative confirmation that the slump in PSCE has probably bottomed in December last year and January this year. PSCE is also an aggregate statistic and must be handled with circumspect. Looking at the underlying components it is clear that credit demand by individuals continues to moderate while businesses are actively looking for more of it.

The various credit categories generally constitute short to medium term commitments so as such may not reflect future expectations as accurately a mortgages, but the obvious difference between household and business demand indicates consolidation in the one category (households) and improved prospects in the other (commercial).

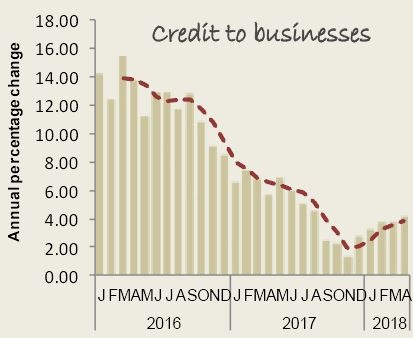

There is now a discernible trend in the demand for commercial credit, having turned in January and continuing year to date to improve every month. In April commercial entities demanded and received 4.1% more credit than in April 2017, while the March growth rate was still a conservative 3.7%. Nevertheless, business credit is by far the single biggest contributor to the overall private sector credit growth of 5.8%

The black hole in the statistics, however, is still the contraction in installment credit. It seems neither private individuals nor companies have an appetite for large ticket items, in our case specifically vehicles, which lead to another month of contraction. In April this type of credit shrunk again, this time by an even bigger 5.2% after the significant contraction of 4.3% in March. Installment credit has now contracted for 11 consecutive months, wiping out most of the gains of 2016 and 2017. Vehicle sales are now starting to look like the construction sector from the second half of 2016 onwards.

If installment sales shrink for another month, it would mean that auto dealers have endured a full year of decreasing sales. Note, it is not growing at a slower rate, it is getting smaller by the month.

Imagine running a car dealership on 2018 overheads and operational expenses, but having to fund this from sales comparable to 2012. I think this is almost impossible and I suspect the automotive industry is in serious pain.