A rational view of 2018 – don’t get stuck behind the curve

It is an observed feature of economic analysts that many of them tend to be behind the curve. In a sense this is unavoidable because one always works with historical figures while forecasts pertain to the future, which can turn out to be quite different than what current conditions predicate.

A similar thing happened this week with some very negative reports crossing my desk while the Minister of Finance, for a change, punted the contrarian view, actually being very upbeat about the rest of the year.

It is an impossible call to make. While the analysts focus on 2017 which turned out worse than expected, the minister focused on the vitality of the Namibian economy. In the one camp, I found plenty of evidence that our national debt has ballooned more than expected, and that this is interpreted as a major impediment to growth.

In the other camp, I find more progressive individuals, looking beyond the immediate ratios, reminding us that a lot of momentum has been restored to the fundamentals despite the statistics remaining stubbornly negative during 2017.

Our economic woes have also, since the beginning of this year, attracted the attention of foreign analysts, now pointing out, somewhat belatedly, that South Africa’s insignificant little neighbour is experiencing an “economic crisis.” These views are prone to be modelled on the more negative domestic position, where we have the advantage of ready access to data, but the disadvantage to get stuck in our own views.

The typical Namibian problem is that we lack a national institution whose job it is to form an integrated view of the economy, and then to advise policymakers on the bigger picture. Our statistics are at most modest, fragmented, delayed and isolated. If you want an integrated picture, you have to construct it yourself, and this can be very subjective since there are only very limited opportunities for a soundboard.

This means collecting data from a variety of sources, and then turning this into a picture representative of the whole. This is not an easy task.

While it is true that the national debt has exceeded the target levels and that it will probably continue to rise over the next two fiscal years, this is not new. Foreign analysts, most notably BMI on whose analysis I put much weight, have pointed out since the tabling of the mid-year budget review last year, that the assumptions of the finance ministry are ambitious and that our debt will continue growing before receding as a percentage of Gross Domestic Product.

Herein lies a key consideration. It is not really necessary that we reduce our debt in nominal or absolute terms, but only in relation to the output of the economy as a whole. Were the Namibian GDP twice its current size, then theoretically the debt can be double what it is now, without any major impact on overall economic performance. This is not rocket science but straight forward common sense.

Yet, it is this common sense part that we overlook. Our focus must no longer be on debt levels, it must be on growth. And comparing a number of indicators and data points from January this year to January last, the improvement is obvious. In the end, whether our debt ratio is 40% or 45% or even 50% of GDP, becomes academic. The only thing that matters is whether we can service the interest on that debt, or re-adjust the market by rolling over large chunks.

By now it must be obvious to even the most cynical observer that the capital market constraints of late 2016 and early 2017 have abated. There is a healthy appetite for Namibian sovereign debt at market rates that I would not describe as punitive.

I think, looking back, it must stand out that the economy has weathered the storm. I do not have a crystal ball but going by fundamentals, it is in my view safe to say that our 2018 outlook has much improved over 2017 real outcomes.

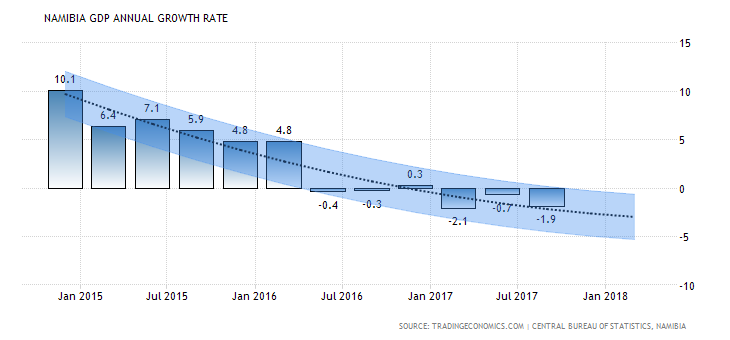

I am biting my nails for the fourth quarter GDP figures. If these turn out positive, regardless how small, then I am convinced that all the indicators pointing to growth, are reliable.