Growing inequality in emerging markets becoming entrenched feature of economic growth

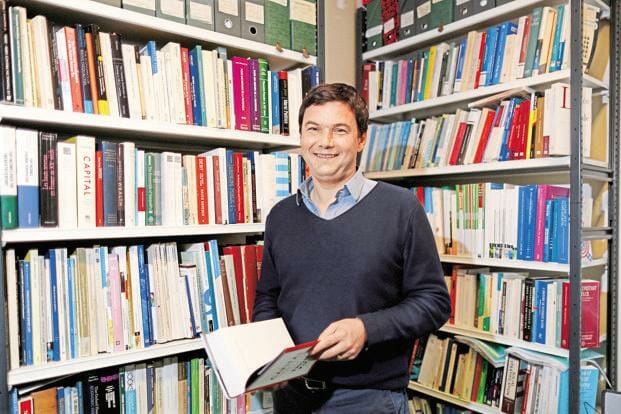

Controversial French economist, Thomas Piketty, together with his working group, has just released the most comprehensive ever report on world inequality. Piketty first grabbed the world’s attention in 2014 when his seminal work, Capital in the 21st Century, was translated into English.

This week, Piketty and his group of economists at the World Inequality Lab, Facundo Alvaredo, Lucas Chancel, Emmanuel Saez and Gabriel Zucman, released the first edition of the World Inequality Report.

The research relies on the most extensive database on the historical evolution of income and wealth inequality. It contributes to a more informed global democratic debate on economic inequality by bringing the most up-to-date and comprehensive data to the public discussion.

Piketty stated “For the first time ever, this report examines how global growth has been shared among individuals in the entire world since the 1980s, with a particular focus on emerging countries where inequality data had previously been sparse or nonexistent.”

The primary research indicates that income inequality has increased in nearly all world regions in recent decades, though at different speeds, highlighting the important roles of governments to mitigate inequality. Since 1980, income inequality has increased rapidly in North America, China, India, and Russia, while growing moderately in Europe. However, there are exceptions to this pattern: in the Middle East, subSahara Africa, and Brazil, income inequality has remained relatively stable, but at extremely high levels.

Lucas Chancel, general coordinator of the report, said: “The fact that inequality trends vary so greatly among countries, even when countries share similar levels of development, highlights the important role of national policies in shaping inequality. For instance, consider China and India since 1980: China recorded much higher growth rates with significantly lower inequality levels than India. The positive conclusion of the World Inequality Report is that policy matters, a lot.”

The report also reveals the dramatic decline in the net wealth of governments over the past decades and the challenges this poses for tackling inequality. Based on the data, the report discusses promising options to tackle income and wealth inequality—starting with the importance of economic data transparency.

Gabriel Zucman said: “The establishment of a global financial registry to record the ownership of financial assets would deal severe blows to tax evasion and money laundering, and would enhance the effectiveness of progressive taxation, which is an essential tool in reducing economic inequality.”

The report stresses the need for more ambitious policies to democratize access to education and well-paying jobs in rich and emerging countries alike. Public investments in health and environmental protection are also necessary to empower younger generations. To finance these investments in the future, capital taxes on the wealthiest or debt relief have regularly been used by governments throughout history.

Key results of the report include the following:

South Africa faces some of the worst income inequality in the world, with the top 1% earners capturing 20% of the national income in 2014. Since the end of the Apartheid in 1994, top-income shares have increased considerably. In spite of several reforms targeting the poorest and fighting the segregationist heritage, race is still a key determinant of differences in income levels, educational attainment, job opportunities and wealth.

On a global scale, since 1980 the richest 1% captured twice as much as the poorest 50% of the world’s population. In other terms, since 1980, 27% of all new income generated worldwide were captured by the richest 1%, while the poorest 50% of the world’s population captured only 13% of total growth. These figures are brought into sharp contrast considering the top 1% currently represents 75 million individuals while the bottom 50% represents 3.7 billion individuals. The population in between, largely comprising lower- and middle-income earners in North America and Europe, experienced sluggish or even zero income growth rates.

Since 1980 there have been large shifts in the ownership of capital. Who owns this capital is crucial in determining inequality. Net private capital–the assets of individuals minus their debts–has risen enormously in recent decades, but conversely, net public capital–the assets of governments minus their debts–has declined in nearly all countries since the 1980s due to large scale privatizations and rising public debts. Public capital is now approaching or below zero in rich countries. This exceptional situation by historical standards has strong implications on policy. In particular, it becomes extremely challenging for governments to invest in education, healthcare or environmental protection.

Wealth inequality among individuals also increased sharply since 1980. Significant increases in top wealth share have been experienced in China and Russia following their transitions from communism to more capitalist economies. The top 1% wealth share doubled in both China and Russia between 1995 and 2015, from 15% to 30% and from 22% to 43%, respectively.

Emmanuel Saez commented “The combination of privatizations and increasing income inequality has fueled the rise of wealth inequality—within countries and at the global level, private capital is increasingly concentrated among a few individuals. This rise was extreme in the US where the share of wealth held by the top 1% rose from 22% in 1980 to 39% in 2014.”

Global income and wealth inequality will steadily rise if countries continue to follow the same trajectory they have been on since 1980, despite strong growth in emerging countries. By 2050, the share of global wealth held by the world’s 0.1% richest (representing 7.5 million individuals today) be equal to that of the middle class (3 billion individuals).

However, rising global inequality is not inevitable in the future and limiting it will have tremendous impacts on global poverty eradication. If all countries follow the same inequality trend as Europe since 1980, the incomes of the bottom half of the world population could rise from €3,100 in 2017 to €9,100 in 2050. Alternatively, if countries were to follow the US trend, the incomes of the bottom 50% would rise to just €4,500 by 2050.

The data presented in the report combines in a systematic and transparent manner all available economic data sources, including household surveys, tax receipts, and income and wealth national accounts (including offshore leaks, when available). The report relies on the analysis of more than 175 million data points on inequality.

The World Wealth and Income Database:

The World Wealth and Income Database (WID.world) is the most extensive database on the historical evolution of income and wealth, combining inequality data sources in a consistent, fully transparent and replicable way to fill a democratic gap. The data and World Inequality Report are available on WID.world—an open access, multi-lingual website with visualization tools—stemming from a collaborative effort from 100 scholars across the globe.