BMI shifts deficit targets further out as government fails to reduce public service

An international economic research company this week modified its view of the government’s ability to attain its own deficit targets, stating that the public service burden, which has not been addressed at all, is the major reason for Namibia failing to rein in its deficit faster. However, the deficit is still expected to gradually reduce, only at a slower pace.

BMI Research, an independent unit operating under the Fitch Group said in their latest analysis that at this point, the economy’s hopes are pinned on increased revenues from mining.

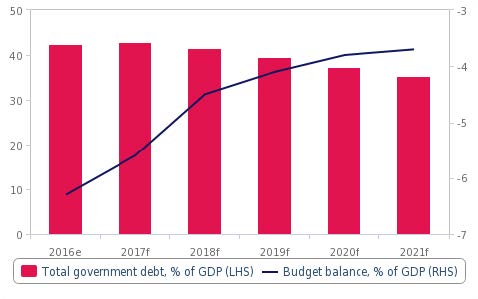

“We now expect the deficit to fall from 6.3% of GDP in 2016/17 to 3.8% by 2020/21, as opposed to 2.3% previously. We believe that Namibia’s debt position will remain stable, as we expect that the debt burden will gradually fall due to a declining requirement for deficit financing and growing levels of real GDP growth. There is a moderate rollover risk which will be complicated by the government’s recent downgrade to junk status but we do not expect it to cause a major threat to the stability of the country’s fiscal position” stated BMI.

BMI Research said in their view “Namibia will continue to see a gradual reduction in its fiscal deficit due to increasing revenues from mining, but its inability to reduce recurrent expenditure significantly will mean that consolidation moves slowly. The narrowing fiscal deficit and growing GDP will see the debt burden gradually decline relative to the size of the economy.”

On the expected contribution of mining, BMI stated “We expect that Namibia’s fiscal deficit will slowly narrow over the coming years, driven by a major increase in government revenues from mining” but it cautioned “However, a weak performance elsewhere in the economy will temper any progress to balance the budget, and with levels of expenditure likely remaining relatively stable, the country will continue to post sizeable fiscal deficits.

“In light of this outlook, while we still expect the fiscal deficit to continue its decline, we have revised our forecasts to show a more gradual pace of narrowing.”

“Our mining team expects that uranium production will increase by 20% in 2018 after doubling in 2017 as the Husab uranium mine moves to full production. This will boost revenues through the 37.5% corporation tax on companies that mine uranium.”

“However, as revenues from the non-mining economy will be more modest, the pace of the deficit narrowing will be somewhat slower than previously expected” BMI stated.