Demand for government paper is strong – bonds and TBs heavily oversubscribed

A one-year tender for Treasure Bills last week was oversubscribed more than three times by local investors.

The results of a 364-day TB tender announced by the Bank of Namibia last week Thursday, 31 August, show that the Ministry of Finance placed N$450 million with nine successful bidders, the yields ranging from 7.95% to 8.05% giving an average yield of 8.028%.

The startling revelation was that just under N$1.5 billion in investor demand was chasing the N$450 million debt supply. The offer was oversubscribed 3.32 times.

Treasury Bills as short-term government paper, are very popular money market instruments. Although their nominal yields are typically less than bonds, the shorter duration to maturity effectively compensate investor for the shorter term. So one can expect TBs to be popular.

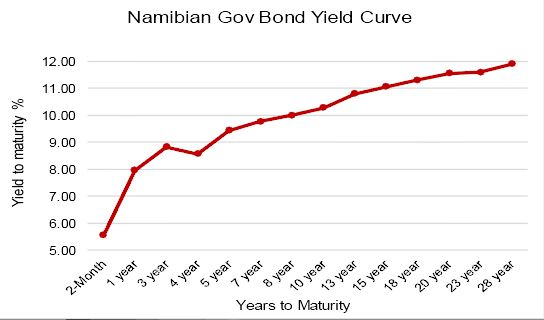

But the results from another auction, this time for the GC bonds or so-called Internal Registered Stock, announced on Tuesday this week also showed an interesting development in the yield curve. Although much longer dated, these bids were for much smaller amounts.

The government asked for N$75 million spread over five tranches of N$15 million each for the GC20, GC25, GC30, GC35 and GC40 bonds. A very interesting picture emerged from the results. It is now clear that, for the time being at least, local institutional investor do not have a need for government paper exceeding a 13-year maturity timeline.

Not suprisingly, there were zero bids for the GC40 bond and the GC 35 received a token N$900,000 from two lonely bidders. Absolutely no appetite for the paper whose maturity lies beyond 2030. But here’s the surprising thing, all three the other bids were oversubsribed and substantially so.

For the GC30, the N$15 million was oversubscribed by 2.19 times, less than for the GC25 and GC20 bonds but still more than double the amount required. The GC 25 was oversubscribed 3.17 times and the GC20 4.72 times. For the latter, an investible amount of N$70.7 million was chasing a supply of only N$15 million.

Yields ranged from 8.2% to 8.9% for the GC 20, from 9.8% to 10.25% for the GC 25 and from 10.75% to 10.79% for the GC 30. Comparing these to the money market result shows indeed a convergence of bond and TB prices, and it can be expected that the long-end of the yield curve will gradually flatten as more longer-dated placements are made at higher bond prices. Currently the tail-end of the curve touches 12% for instruments with maturity in 2040.

The first important observation is that institutional liquidity is back and it is high. This is reflected in the ample oversubscription for all instruments except the longer-dated ones. Secondly, confidence, at least by domestic investors, is rising, especially over the short to medium term. This is shown by the reduction in yields and by the narrowing of the spread between highest and lowest bidders. And thirdly, perhaps the most important observation, there is very little or zero demand for government paper beyond 2030.

I am not too concerned about the lack of appetite for the longer-dated instruments. The GC35 and GC40 bonds are a novelty in the sense that they were only listed not so long ago, to move some of the government’s obligations out to dates further into the future. This is to relieve the need for redemption payments at maturity. Longer maturities was seen as a mechanism to reduce some of the short to medium term pressures on the government bond book, albeit at a higher cost.

From the results of these two auctions, I assume that liquidity is at or near what would be considered normal for the current phase in the economic cycle. The results are very promising compared to what transpired in both the money and the capital markets from around November last year to about the end of May this year.

If the government continues to place its debt so easily in the domestic market, then now is the time to activate the Nam02, 03 and 04 bonds on the Johannesburg Securities Exchange. Downgrade or not, I do not think there is a material difference between domestic Namibian bonds and the ZAR denominated bonds listed in South Africa despite the 160 to 210 basis point spread between the Namibian bonds and their SA benchmark counterparts.