Mining seismic survey updates shows Gemsbok as a prospect gem

Global Petroleum announced this week, the completion of the 2D seismic acquisition programme that it had previously announced, in the Company’s Namibian operated block.

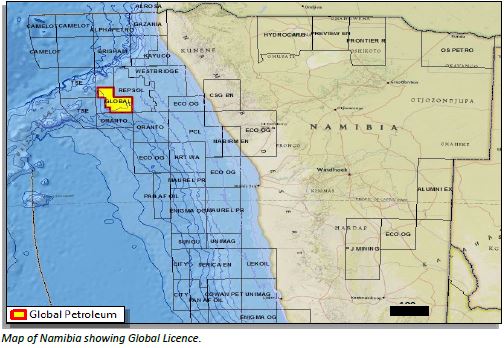

The Gemsbok prospect is located at a total depth of around 3,000 metres – in water depths of approximately 1,400 metres. Global’s Licence PEL 0029, in which the Company holds an 85% interest and operatorship, covers Offshore Blocks 1910B and 2010A offshore Namibia.

“Global Petroleum’s technical team is both intrigued and highly encouraged by its recent work which has confirmed the Gemsbok prospect, a structural closure extending over 200 square kms,” Global CEO,and Managing Director,Peter Hill said in a statement in June 2017, adding that it is unusual to identify such a large, robust structure at prospective depths which does not rely on stratigraphic trapping.”

The new 2D survey is expected significantly to clarify the nature and extent of Gemsbok. In addition, the survey has been specifically designed to improve resolution of the deeper sync-rift section adjacent to the Gemsbok structure, as well as to provide a more accurate understanding of the deeper sedimentary sequence where it is believed potential source rocks are likely to be present

The survey comprising 834 km of full fold 2D seismic data – was carried out by Seabird Exploration of Norway, and shooting took only 10 days, completing on 3rd July 2017. The total cost of the acquisition is approximately US$740,000, excluding processing.

Processing of the acquired data is about to commence and is expected to be finalised around the end of September 2017. Initial examination of the high quality raw data confirms the extremely large extent of the Gemsbok prospect in the south east of the block. Following processing and interpretation of the data the Company will determine its plans for the next phase of exploration.

Global’s Licence PEL 0029, in which the Company hold an 85% interest and operatorship, covers Offshore Blocks 1910B and 2010A. The Gemsbok prospect is located at a total depth of around 3,000 metres – in water depths of approximately 1,400 metres.

Global had entered into a contract with Seabird Exploration of Norway to take on 834 km of full fold 2D seismic data covering Global’s operated block.