Construction sector shows modest growth amid government spending decline

According to the latest building statistics for May 2024 analysis by Simonis Storm Securities (SSS), the construction sector experienced a modest year-on-year growth of 3.5% in the first quarter of 2024.

This follows three consecutive quarters of decline and marks a significant slowdown from the 26.8% growth recorded in the same period last year, which the Namibia Statistics Agency (NSA) attributed this marginal growth primarily to activities in the green hydrogen sector.

Government expenditure on construction, however, saw a sharp decline of 31.5% year-on-year in the first quarter of 2024, contrasting starkly with the 15.9% growth observed during the same period in 2023. This reduction in spending, particularly evident in transport infrastructure projects, contributed significantly to the sluggish overall growth of the construction industry, as reported by the NSA.

In terms of building approvals and completions, there was a 1% year-on-year increase in the real value of approved and completed building plans in the first quarter of 2024. This represents an improvement from the -5.5% year-on-year decline seen in the first quarter of 2023, although it is lower than the 15.7% growth recorded in the previous quarter.

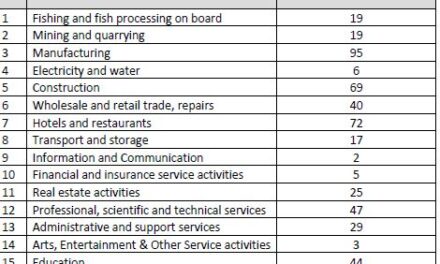

Focusing on developments in Windhoek, May saw a notable increase in building plan approvals. Approvals rose by 7.6% month-on-month and 13.1% year-on-year compared to May 2023. A total of 199 plans were approved, amounting to N$164.5 million. The majority of these approvals were concentrated in Khomasdal, Klein Windhoek, and Katutura, with 147 plans for additions to existing structures, 35 for new houses, 10 for walls, six for commercial uses, and one for a pool.

During the same period, the number of completed buildings in Windhoek surged to 190, a significant increase from the 37 completed in May 2023. This rise can be attributed to increased follow-up inspections by the City of Windhoek (CoW) to assess project completions, as previously anticipated.

In Swakopmund, 75 building plans valued at N$67.2 million were approved, with 40 plans valued at N$31.3 million completed during the review period (Figure 4). Additionally, 66 building projects valued at N$46.6 million were submitted. The majority of approved plans were for new residential buildings, reflecting ongoing development in the area.

Applications for land in Lüderitz showed variability, with 37 applications recorded in the first five months of 2024, down from 104 in 2023. This decline follows fluctuations in previous years and aligns with broader trends in land application processes, including the implementation of the Flexible Land Tenure System (FLTS).

The cessation of informal land applications from 2022 onward reflects ongoing preparations and planning required to support the FLTS implementation, ensuring secure land rights and effective town planning.