Offshore exploration in appraisal drilling phase – Investment Board Chief Executive

By Clifton Movirongo.

With all the hype around the recent discoveries of substantial oil sources in Namibia’s offshore acreage, the Namibia Investment Promotion and Development Board’s (NIPDB) Chief Executive, M. Nangula Uaandja recently pointed out that it is “still a long way to go” before the production phase begins.

Ms Uaandja walked participants at the Namibia Oil and Gas Conference 2023 through a timeline of the complete oil and gas cycle, which begins with data acquisition (+/-4 years), exploration drilling (+/-4 years), appraisal drilling (+/-4 years), field development (+/-5 years), and production operations (20 to 40 years).

According to her presentation at the conference, the chance of success in the first phase is 0-10%, 15-20% in the second phase, 30-50% in the third phase, and +80% in the field development phase.

She said that oil companies have been working behind closed doors for months, analyzing data, and drilling, and are currently busy with appraisal drilling.

They estimated that the first phase will require N$300 million to N$900 million in investment, N$1.5 billion in the second, +/-N$8 billion in the third, N$80 billion to N$300 billion in the field development phase, and a multi-billion government take in the production phase.

“It is great to be excited, but I think it is also important for Namibians to be cautiously optimistic. One word of caution: Not every country that has found oil has produced oil, and many times, it is not about the fact that it is commercially feasible, but there are other factors involved,” she noted.

She pointed out that these include things like oil discoveries and commercial amounts. “There seems to be a significant amount, but can they be commercially produced? Commercially means the cost of production and if it would be feasible to compete with the US crude oil price per barrel at the current rate,” she told the participants. “That is what we need to understand from the appraisal drilling, and only once that is determined, there will be full production.”

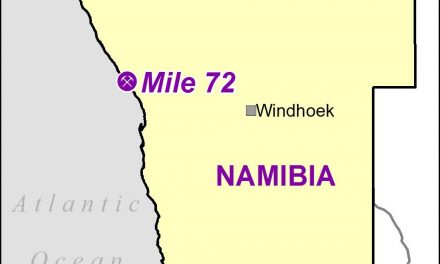

Shell Namibia Upstream B.V. (Operator) owns 45%, Qatar Energy LLC owns 45%, and Namcor (carried interest) controls 10% of the light crude oil discovered in the Graff 1 Well under PEL No. 39, with an estimated capacity of 300 to 400 million barrels and located approximately 250 km from Oranjemund.

In addition, TotalEnergies EP Namibia B.V. owns 40%, Qatar Energy LLC owns 30%, Impact Oil and Gas Ltd. holds 20%, and Namcor controls 10% of the oil in the Venus 1 Well in PEL 56 adjacenty to Graff 1.